Zolnierek/iStock via Getty Images

Alnylam Sues Moderna, Pfizer, Over Patent Infringements Relating To COVID Vaccines

Alnylam (NASDAQ:ALNY), the $20bn market cap specialist developer of RNA-interference therapeutics, announced last week that it had filed patent infringement suits against both Moderna (MRNA) and Pfizer (PFE), the mRNA specialist and the major pharmaceutical, over their use of biodegradable cationic lipids in their hugely successful COVID-19 vaccines, Spikevax and Comirnaty.

These 2 vaccines earned a combined total of ~$55bn last year – $18.5bn for Moderna, and $37bn for Pfizer – who shared profits equally with its development partner BioNTech (BNTX) – so it is easy to see why Alnylam would make such a claim, if it felt it had sufficient proof that both companies had infringed its U.S. Patent No. 11,246,933.

Alnylam is “seeking fair compensation for use of its technology”, and says that it “does not intend to seek an injunction or take action that impedes production, sale or distribution of the vaccines”, adding that it is “proud this work has supported rapid development of the life-saving vaccines.”

In a press release, Moderna – which is already facing a patent infringement lawsuit from the biotechs Arbutus Biopharma (ABUS) and Genevant over the lipid vesicles and nucleic acid-lipid particles used in its delivery technology – issued a statement claiming that:

Alnylam has engaged in what can only be seen as blatant opportunism—improperly expanding the scope of a ten-year old patent in an attempt to stake a claim to unprecedented and meaningful innovations in the mRNA space.

Pfizer – whose Canadian partner Acuitas has preemptively sued Arbutus (claiming several of its patents are invalid) to apparently head off any potential litigation aimed at the big Pharma by the biotech – has yet to make any statement in response to Alnylam.

Investment Thesis – The Issue At Stake Is Lipid Nanoparticle Technology – Whoever Wins Will Thrive

Doubtless Pfizer will mount a similar defence to Moderna’s in time, but is Alnylam right to make its claim, and if the legal actions are successful or unsuccessful, what will the implications be?

In this article, I will first of all discuss Alnylam the company, and Alnylam the stock – up 210% across the past 5 years, and 13% across the past 12 months – to give readers a better understanding of the company, its products and its science and technology.

I will then move on and discuss the legal action in some more detail, and how it may impact the company going forward – it is thought that the dispute will take at least 2 years to resolve in the courts – and finally, I’ll speculate on how Alnylam’s share price may perform in the short, medium, and long term.

The company’s Achilles’ heel has traditionally been its cash burn, and ironically, its drug delivery capabilities, which has restricted its targets (and those of its rivals) mainly to rare diseases of the liver.

The arrival of messenger-RNA technology initially looked as though it might make RNAi technology look outmoded, and succeed where RNAi could not – in ex-hepatic disease modalities – but COVID aside, mRNA-based developers may actually face the same obstacles as the RNAi developers – namely effective drug delivery.

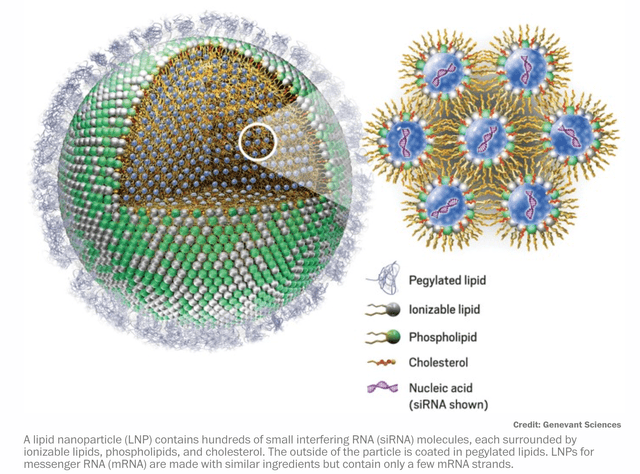

That is why lipid nanoparticle (“LNP”) technology, and litigation, is so critical to the success of RNAi and mRNA companies alike – LNPs can get strands of mRNA and RNA to where they need to be in order to treat diseases effectively. It’s hardly an exaggeration to say that whoever controls LNP technology controls the mRNA, RNAi, and even, perhaps, the gene-editing markets.

Alnylam has bucked the prevailing biotech bear market trend, and its share price is riding high, priced at $163 at the time of writing, but arguably, its share price may surge as Moderna and Pfizer’s fall if it can successfully claim to have been the original developer of the key aspects of LNP technology.

Priced at 20x forecast 2022 sales, and making a sizable net loss of $852m in FY21, for EPS of -$7.2, Alnylam’s current market valuation might appear to many investors as a little too generous.

Until recently, I might have agreed, but if delivery technology is really at the heart of successful RNAi and mRNA technology, and Alnylam can prove its case, then all of the recent momentum enjoyed by mRNA pioneers may switch to RNAi going forward.

Such a scenario would make Alnylam a tantalising buy opportunity.

Alnylam Overview – A Successful RNAi Biotech, But Restricted To The Liver

As mentioned, it is drug delivery issues perhaps more than any other hurdle that has prevented Alnylam from developing the Nobel prize winning RNAi technology it has licensed and patented and uses to develop drugs into a more successful, lucrative, product portfolio.

To date, Alnylam – based in Cambridge, Massachusetts – where Moderna is also headquartered – and founded in 2002 – joining the Nasdaq in 2004, has successfully developed and commercialised 4 drugs, but no mega-blockbusters comparable to Spikevax or Comirnaty.

The commercialised drugs are ONPATTRO (patisiran), indicated for treatment of polyneuropathy of hereditary transthyretin-mediated amyloidosis (“hATTR”) amyloidosis; GIVLAARI (givosiran), indicated for acute hepatic porphyria (“AHP”), OXLUMO (lumasiran), indicated for primary hyperoxaluria type 1 (“PH1”) and Leqvio (inclisiran), licensed to the Pharma Novartis (NVS) and approved in the EU for hypercholesterolemia or mixed dyslipidemia.

It is not a bad approval record – superior to any other RNAi or antisense (similar to RNAi but using single stranded DNA oligonucleotides as opposed to double stranded RNA) specialist, e.g. Ionis Pharmaceuticals (IONS), with 3 approved products, or Arrowhead (ARWR), and Dicerna – recently acquired by Novo Nordisk (NVO) in a $3bn deal – none of which has commercialised a single product.

Alnylam’s product revenues increased by 83% year-on-year in 2021, to $662m, whilst collaboration revenues increased by 38% to $181m, meaning the company also overtook Ionis – which earned $810.5m of revenues in 2021 – in terms of revenue generation in 2021. The company has forecast for a further 44% uplift in 2022, to ~$900m – $1bn of product revenue, and $175-$225m of collaboration revenue, for a total of ~$1.15bn at the midpoint of expectations.

Alnylam’s twin, interrelated problems, as mentioned above, are its losses and its inability to address diseases outside of the liver however.

The company reported current assets of $2.8bn as of FY21, including $820m cash and $1.55bn marketable debt securities, so its funding runway is extensive, but management expects that total R&D and SG&A costs will increase by 18% in FY22, from $1.23bn, to $1.45bn.

Plus, there will likely be ~$150m of interest expense – total liabilities were reported as ~$3bn as of Q421 – and >$100 cost of goods sold (“COGS”), so in all likelihood Alnylam may record a >$500m loss this year.

Alnylam’s Pipeline Has Promise – Although There Are Caveats

Looking ahead, 2022 does promise to be a catalyst-rich year for the company, as we can see below:

Alnylam drug development goals in 2022 (Q421 earnings presentation)

Vutrisiran – a version of Onpattro that can be dosed subcutaneously as opposed to as an infusion, has been forecast by analysts to make ~$1.8bn of sales by 2026. Onpattro itself earned $475m in 2021, treating ~2,050 patients, but Vutrisiran may also target cardiomyopathy (“CM”) and a market of ~200K patients, compared to 50K in hATTR.

The approval date for Vutrisiran in hATTR, or polyneuropathy (“PN”), is scheduled for April 14th. Another target is Stargardt disease, a form of blindness, a ~30K patient market. Alnylam’s biggest rival in this space is Pfizer, whose Vyndaqel/Vyndamax earned >$1.5bn of revenues in FY21.

Leqvio – approved in December 2021 – will not be a significant revenue generator for Alnylam. My understanding from reviewing the company’s 2021 10-K submission is that the company has traded its right to receive 10-20% royalties on net sales by Novartis to Blackstone Royalties.

Fitusiran, a therapy targeting hemophilia, is being developed by French Pharma Sanofi (SNY), with Alnylam set to receive a 15-30% royalty on net sales. Sanofi expects to submit Fitusiran for approval in 2022, although the path to approval has been somewhat chequered and Alnylam is unlikely to see much more than $100m in annual revenues from this source in my view.

Does Lipid Nanoparticle Technology Offer The Delivery Solution Alnylam Desperately Needs?

A statement in Alnylam’s latest 10-K submission reads as follows:

we have advanced proprietary technology that conjugates a sugar molecule called GalNAc to the siRNA molecule. This simpler delivery approach enables more convenient, subcutaneous administration of our drug candidates directed to liver expressed target genes, a key aspect of our platform.

GalNAc – a bit like lipid nanoparticles – is a technology used by all of the RNAi therapeutics developers, but is ineffective outside of the liver. Alnylam is collaborating with Regeneron (REGN) – marketer and seller of $9bn per annum selling Eylea, indicated for the ocular condition Wet AMD – on an “alternative conjugate approach based on a hexadecyl (C16) moiety as a lipophilic ligand”, for ocular and CNS, and has also agreed a collaboration with Japan based PeptiDream to “discover and develop peptide-siRNA conjugates for targeted delivery of RNAi therapeutics to a broader range of extrahepatic tissues.”

In other words, Alnylam is making every effort to find ways to deliver its delicate strands of RNA to target cells so they can do their work. mRNA is significantly less fragile than RNA, but nevertheless, were it not for lipid nanoparticle technology, the mRNA contained in Moderna and Pfizer’s vaccines – with instructions to manufacture the Spike protein present on Coronavirus in order to teach the immune system to recognise and destroy the virus – would never make it to the desired target cells.

LNPs are often referred to as the “unsung hero” of COVID vaccines, and with good reason. This in-depth article from Chemical and Engineering news – written in early 2021 – charts the progress of the delivery device, and name-checks Alnylam as one of the key developers of the technology from 2005 onwards. It would certainly make sense for Alnylam to be studying LNPs intensively, given the opportunity they offered the company to finally make it out of the liver and into more lucrative disease modalities.

Explanation of how LNPs work with RNA and MRNA (Chemical and Engineering news)

It is understandable that, after releasing their >95% effective vaccines in November 2020, most people thought that messenger-RNA was the genius underlying science that made them so effective, but arguably, it was LNP technology that made everything possible. To stretch a point, perhaps Alnylam could even have released a successful vaccine of its own, using small interfering RNA (“siRNA”), using LNPs as protection.

That didn’t happen, but looking ahead, as the pandemic eases and the revenues generated from Spikevax and Comirnaty – theoretically at least – decline substantially, RNAi+LNP and mRNA+LNP are likely to compete against one another is a number of different fields – oncology, fibrosis, cardiovascular, CNS, and kidney, to name a few.

Alnylam’s Case Against Moderna and Pfizer

In 2022 however, Pfizer says it is likely to earn ~$32bn from sales of Comirnaty, and Moderna believes it will earn ~$19bn from Spikevax, so regardless of what may happen in the years to come, Alnylam may well be making a wise move in attempting to claim a percentage of ~$51bn revenues in 2022, after $55bn in 2021, plus whatever may be sold after 2022.

In its documentation relating to its challenge against Moderna, Alnylam refers to a meeting in April 2014 in which:

Alnylam presented a detailed PowerPoint disclosing Alnylam’s LNP Technology and how those LNPs could be used for developing RNA-based pharmaceuticals. Alnylam further disclosed valuable rodent and non-human primate pharmacology experiments that showed superior in vivo elimination of its biodegradable LNPs, while also showing superior potency….

Upon information and belief, as of 2014, Moderna did not possess a cationic lipid with biodegradable groups sufficient to form a LNP with desirable properties to deliver RNA materials for use in therapeutics and vaccines. Upon information and belief, Moderna did not make the infringing SM-102 – a cationic lipid with biodegradable groups that uses the Alnylam LNP Technology – until sometime in 2015 for use in non-COVID vaccines Moderna was developing.

In its documentation relating to Pfizer, the case is perhaps less persuasively made (but still seems reasonable) with a statement made on Pfizer’s website apparently constituting proof that without Alnylam’s LNP technology, Comirnaty would not have been a success.

Regarding these LNPs, Defendant Pfizer Inc.’s website states “[t]his tiny fat glob, known as a functional lipid, is actually one of four lipids that make up the lipid nanoparticles that go into the vaccine. Without these lipid nanoparticles, in fact, there could be no Pfizer-BioNTech mRNA vaccine. That’s because mRNA, which is the genetic material that teaches our cells to make the protein that will help our immune systems produce antibodies that helps to protect us from COVID-19, is incredibly delicate.”

Alnylam doesn’t specify in its documentation exactly what level of financial compensation it is seeking, but a percentage of total revenues – past and future – would seem likely. For context, Acuitas refers to “hundreds of millions, if not billions, of dollars in unjustified royalties” being claimed by Arbutus in its suing of Pfizer.

The Implications Of A Judgement Could Be Seismic

If, for example, a court were to award Alnylam a 1% share of Moderna / Pfizer COVID vaccine revenues, it would be worth >$1bn to the company, if back-dated, plus future revenues. If it were 5%, $5bn, 15%, $15bn, and so on.

RNAi and mRNA drug developers both target proteins that play a key role in the development of diseases, but they approach the problem from different angles. mRNA seeks to instruct the body to manufacture certain proteins, whilst RNA is designed to degrade messenger-RNA, preventing the production of certain proteins.

As such, if Alnylam were to strike a multi-billion blow against both Moderna and Pfizer – pioneers of mRNA drug development – it wouldn’t just work out well financially for the company, it might hand it a significant competitive advantage when it comes to developing new drugs – from cancer vaccines, to rare genetic diseases.

Intriguingly, even gene editing companies that use CRISPR-Cas9 technology are experimenting with LNP based drug delivery – it is almost as if, once inside the target cell, there are several different techniques that can be used to improve disease symptoms and even cure diseases. The really tough problem – solved by LNP – is how to get there in the first place.

Conclusion – The Strength of Alnylam’s Case Is Not Yet Known – But The Implications of Victory Are Very Positive

As mentioned, Alnylam has delivered wonderfully well for its investors over a 5-year period, and during an unprecedented bear market, the company has succeeded in growing its share price by >10% when most small-to-mid-sized companies are seeing their market valuations reduced by half.

But arguably, Alnylam has never quite delivered on the full promise of RNAi technology to treat and cure diseases. Just as its R&D team were getting closer and closer to a breakthrough with LNPs, along came Moderna and Pfizer / BioNTech and used the technology to create the top 2 best-selling drugs of 2021, and probably 2022.

As such, I find it understandable that Alnylam has made the move it has, launching lawsuits against both companies, although I wonder why Alnylam left it so late, and how strong its case is.

Moderna has lost the first round of its case against Arbutus, and although some analysts believe Moderna will eventually push for a settlement, a company the size of Alnylam’s, with its cash resources, can afford to try to take Moderna and Pfizer for as much as it can get, striking a blow against each in the battle to develop new and better protein based drugs in the future.

That, to my mind, is an exciting possibility, as is the possibility that Alnylam can finally apply LNP successfully to its own drugs, and enter more lucrative fields and markets.

Alnylam stock is not cheap, but it is discounted by >20% from October 2021 highs of ~$210, and the more I look at LNP technology and what it means to mRNA, RNAi, and even gene-editing drug developers, the more I believe control of drug delivery patents spells success.

It may be a very interesting space to watch for the next 2 years, and it’s hard to argue that Alnylam wasn’t active in the LNP technology space a long time before either Moderna or Pfizer. I find myself seeing Alnylam and its shares in a much more positive light with this additional opportunity in play.

seekingalpha.com

George is Digismak’s reported cum editor with 13 years of experience in Journalism