Introduction: UK consumer confidence hammered by cost of living

Good morning, and welcome to our live rolling coverage of business, economics and financial markets.

The cost of living crisis has knocked UK consumer confidence down to its lowest level since the pandemic, as rising food and energy bills hammer families.

There has been a “significant and sustained drop-off in consumer sentiment”, leading to the biggest one-year drop in confidence since the global financial crisis, a new report from PwC this morning shows.

Its index of UK consumer confidence has dropped to -20 this month, from +10 last summer. That’s barely above the -26 recorded at the start of the pandemic two years ago.

PwC warns that this dramatic drop shows the impact that the cost of living crisis is having across the UK.

Lisa Hooker, Leader of Industry for Consumer Markets, PwC UK, says:

“This shift in sentiment is both significant and sudden, with consumer spending expectations moving towards more essential areas at the expense of discretionary items. Businesses that help customers by offering them the options to trade down are more likely to keep their loyalty for when things get better.”

The 30-point drop over the last nine months is the biggest sustained decline in PwC’s survey since the 2008 Global Financial Crisis, as households face the biggest squeeze in in decaces.

Energy bills have just soared, and could do so again in October, while food price inflation is the fastest in 10 years.

More details to follow…..

Also coming up today

Eurozone finance ministers will discuss the impact of the war in Ukraine on Europe’s economies when they hold a Eurogroup meeting today, as pressure grows for a ban on imports of Russian gas.

They will also discuss how a digital euro could be designed, and the trade-offs between privacy and preventing money laundering, illicit financing and tax evasion.

European stock markets have opened a little higher, despite worries over rising inflation, slower growth and the impact of the Ukraine war.

The problems facing global equity markets remain constant – rampant inflation, soaring energy prices, higher taxes & geopolitical fallout. Oil $104. Asia buoyant on tech. Suggested opening calls calm & reflective. FTSE +36 @ 7573 DAX +30 @ 14476 CAC +12 at 6696 DJIA unch at 34818

— David Buik (@truemagic68) April 4, 2022

The agenda

- 7am BST: German trade balance for February

- 10.05am BST: Bank of England governor Andrew Bailey: Speech at the Stop Scams Conference

- From 2pm BST: Eurogroup meeting of eurozone finance ministers in Luxembourg.

- 3pm BST: Bank of England deputy governor Sir Jon Cunliffe speech at a European Economics & Financial Centre seminar

- 3pm BST: US factory orders for February

Manufacturing PMI at 18-month low as Ukraine war and Omicron wave disrupt growth

Global manufacturing growth has slowed to an 18-month low, as the Russia-Ukraine war and the ongoing Covid-19 pandemic both weigh on the world economy.

That’s according to the latest survey of purchasing managers from S&P Global, which found that:

Production and demand growth was subdued by a combination of headwinds, including the Ukraine war and new COVID-19 related disruptions – notably in China.

These headwinds led to an intensification of supply chain delays and re-acceleration of price pressures, as well as a renewed fall in global trade flows. Business confidence also fell sharply, down to the lowest since September 2020, signalling downside risks to output growth in the second quarter.

Global manufacturing activity slows to 18-month low in March, according to PMI survey data. “Business confidence also fell sharply, down to the lowest since September 2020, signalling downside risks to output growth in the second quarter”: https://t.co/dsy0RrDXgV pic.twitter.com/BnswD6u1n0

— James Picerno (@jpicerno) April 4, 2022

British Airways is also caught up in the travel disruption at UK airports today.

BA has cancelled about 100 flights, although only about five were last-minute cancellations directly related to staff absence, a spokesperson said.

The rest of the cancellations had already been made for different reasons and the airline was aiming to keep cancellations to high-frequency routes such as Paris and Madrid.

My colleague Jasper Jolly has more details here:

The European Bank for Reconstruction and Development’s board of governors has voted to suspend access for Russia and Belarus to its financing and other resources with immediate effect.

The move, following the invasion of Ukraine in late February, means that there can be no new financing of projects or technical cooperation activities in either country.

The EBRD could also suspend or cancel further disbursements of funding on existing projects.

1.1 We’re moving ahead with our plans to exclude Russia and Belarus from receiving funding for projects.

The EBRD Board of Governors have approved taking firm action against the Russian Federation & Belarus following the invasion of Ukraine. https://t.co/w0p7JrjgBu pic.twitter.com/0Vwq8LZP6N

— The EBRD (@EBRD) April 4, 2022

1.2 Access by the Russian Federation and Belarus to the resources of the Bank is to be formally suspended with immediate effect.

This means that there can be no new financing of projects or technical cooperation activities in either country. https://t.co/w0p7JrjgBu

— The EBRD (@EBRD) April 4, 2022

1.3 Furthermore, the Bank avails itself of all rights to suspend or cancel further disbursements of funding on existing projects. https://t.co/w0p7JrjgBu

— The EBRD (@EBRD) April 4, 2022

EBRD president, Odile Renaud-Basso, said:

“It is sad that we have come to this point after so many years of cooperation and activity in both countries.

However, the Russian-led war on Ukraine has left us no choice but to show our condemnation with more than just words. Actions are required, too, so that the two countries are in no doubt that we believe they have undermined the values which are important to us as an institution and to the international community.”

The EBRD added that it is now focussed on delivering a €2bn Resilience and Livelihoods Support Package for Ukraine and for other countries in the region directly impacted by the refugee crisis.

Reuters points out that the EBRD has not put new money to work in Russia since Moscow annexed Crimea in 2014, and also introduced a moratorium on new investment in Belarus following the country’s disputed 2020 election.

Germany faces steep recession if Russian oil and gas halted, say banks

Germany will face a steep recession if there is a stop to imports or delivery of Russian gas and oil, a top German bank lobby warned today (Reuters reports).

Europe’s largest economy is heavily dependent upon Russia for energy, and nations banks echoed concerns over possible energy disruption expressed by big names in industry in recent days.

Christian Sewing, the chief executive of Deutsche Bank, said in his role as president of Germany’s BDB bank lobby that banks expected sharply slower growth this year of around 2% due to the war in Ukraine.

Sewing told journalists:

“The situation would be even worse if imports or supplies of Russian oil and natural gas were to be halted. A significant recession in Germany would then be virtually unavoidable.”

“The question of government aid measures for companies and sectors would then become even more urgent,” he said.

Sewing once again called on the European Central Bank to act to fend off inflation.

He said the ECB should end its net asset purchases soon and should send a signal with interest rates, adding:

“A signal that is urgently needed.”

Ted Baker has put itself up for sale after receiving a third takeover approach by US private equity suitor Sycamore Partners.

Shares in the company have jumped 13% this morning after the fashion brand launched a formal sale process, and said it had also received another “unsolicited” approach by an unnamed party.

It comes a week after Ted Baker rejected two takeover approaches by Sycamore; the second valued the business at £254m.

The first proposals were rejected after they “significantly undervalued” Ted Baker, the company board said.

The retail firm did not disclose the value of the latest approach by Sycamore or the unnamed third party.

“In view of the interest expressed by potential offerors, and having consulted its major shareholders, the board has decided to conduct an orderly process to establish whether there is a bidder prepared to offer a value that the board considers attractive relative to the standalone prospects of Ted Baker as a listed company.”

European markets mixed as airline stocks dip

In the City, the FTSE 100 index has inched higher this morning, although travel companies, hospitality firms and banks are lower.

The blue-chip index is up 15 points at 7552 points, approaching last Thursday’s six-week highs.

Housebuilders are in the risers, along with weapons manufacturer BAE Systems (+2%).

British Airlines parent company, IAG (-1.4%), is leading the fallers, followed by insurer Aviva (-1.35%) and NatWest bank (-1%). Hotel chain InterContinental (-0.85%) is also in the fallers, with miners also lower.

On the smaller FTSE 250, easyJet shares have dropped by 2% after it was forced to cancel flights as more staff fell ill with Covid. SSP, which

European markets are mixed, with Germany’s DAX flat and France’s CAC 0.25% higher.

Investors are anticipating a series of US interest rate rises this year after America’s jobless rate fell to 3.6% last Friday. That could slow the recovery, as the US Federal Reserve tries to get a grip on inflation which hit 7.9% in the US (higher than the UK, but lagging Turkey…).

Richard Hunter, head of markets at interactive investor, adds:

Elsewhere, the conflict between Russia and Ukraine continues to engender a split between hope and despair. Reports of some progress in talks aimed at ending the war continue to be offset by further reports of Russian atrocities which have seemingly strengthened the resolve of other nations to ratchet up sanctions once more.

The oil price has shown some recent weakness after the actual and potential release of further supply, alongside a truce in Yemen, although even allowing for this dip the price is still ahead by 36% so far this year.

Turkish inflation hits 20-year high of 61%

In Turkey, inflation has soared over 60% (!) as rising energy and commodity costs intensify its cost of living crisis.

Turkey’s annual inflation hit a fresh 20-year high of 61.14% in March, new data this morning shows, the highest since 2002.

Turkish inflation had already been soaring after the lira crashed last year, following a series of interest rate cuts by Turkey’s central bank under pressure from president Recep Tayyip Erdoğan.

The Ukraine war, which drove up the cost of oil, gas, metals, fertiliser and other commodities, has intensified those price pressures, with food prices up 70% per year and transport costs almost doubling.

The report also shows that Turkish factories have more than doubled their prices over the last year, as they passed on soaring costs to their customers.

The producer price index climbed 9.19% month-on-month in March alone, giving a jaw-dropping annual rise of 114.97%.

Speaking of Russian energy imports…

Your daily reminder of the stark split between the European rhetoric (war crimes, strong sanctions…) vs the reality (EU imports of Russian gas **via Ukraine** have climbed this morning to a fresh post-invasion high).

The chart below is Russian gas flow at the Velke station pic.twitter.com/SQiIr8x5qB

— Javier Blas (@JavierBlas) April 4, 2022

German trade picked up in February, but imports and exports with Russia both fell after the Ukraine war began.

Statistics body Destatis reports that German exports rose by 6.4% month-on-month in February, while imports were 4.5% higher than in January.

Exports of German goods to other EU members were 10.4% higher, suggesting demand picked up as the Omicron wave receded.

That pick-up in trade could help Germany’s economy return to growth after contracting in the last quarter of 2021, and thus avoid a recession.

Trade with the Russian Federation was down “markedly”, Destatis adds, with exports down 6.3% and imports falling 7.3% compared with January, in an early sign of the impact of sanctions:

Trade with Russia was not restricted until late February 2022 as a result of Russia’s attack on Ukraine and the sanctions imposed as a consequence.

It is expected that, as of reference month March, foreign trade figures will show in detail in how far the sanctions, further measures to restrict exports and unsanctioned behaviour of market participants will further impact German trade with the Russian Federation.

Germany’s defence minister said on Sunday that the European Union must discuss banning the import of Russian gas, after the discovery of the bodies of hundreds of civilians in towns near Kyiv, many with bound hands, close-range gunshot wounds and signs of torture, and a mass grave in the town of Bucha.

Watchdogs probe London nickel trading chaos

City watchdogs have launched an investigation into chaotic nickel trading in London last month.

The Financial Conduct Authority will examine why the London Metal Exchange (LME) suspended nickel trading for several days after a ‘disorderly market’ in the metal arose.

The LME halted nickel trading after sanctions on Russia drove the price to record levels, creating a ‘short squeeze’ on traders who had bet against nickel.

The FCA says it intends to review “the LME’s approach to managing the suspension and resumption of the market in nickel to determine what lessons might be learned in relation to the LME’s governance and market oversight arrangements.”

The Prudential Regulation Authority (part of the Bank of England) will look into the actions of LME Clear, its clearing house, to see “whether any lessons might be learned” regarding its governance and risk management.

The LME halted nickel trading on 8th March and then cancelled that day’s trades, worth around $4bn, after the short squeeze caused nickel prices to more than double to $100,000 per tonne.

The fiasco centred on a Chinese tycoon known as “Big Shot”. Xiang Guangda controls the world’s largest nickel producer, China’s Tsingshan Holding Group, and had taken a large short position on nickel.

As the nickel price soared, Xiang’s losses on his short position increased – reportedly hitting around $8bn before trading was suspended, and then reopened with daily price limits. Nickel then fell back sharply — bringing some relief to Xiang, but not those on the other side of the trades.

Hedge funds were reportedly considering legal action against the LME over its decision to halt trading and cancel trades in nickel, which is currently trading around $33,000 per tonne.

The LME, meanwhile, has announced new 15% daily price limits for all its metals,m to avoid a repeat of the chaos.

In other airline news, Ryanair has narrowed its forecast for its losses over the last 12 month.

The Dublin-based airline now expects to make a net loss of between €350m and €400m for the financial year to 31st March (last Thursday). It had previously guided for a loss between €250m-€450m.

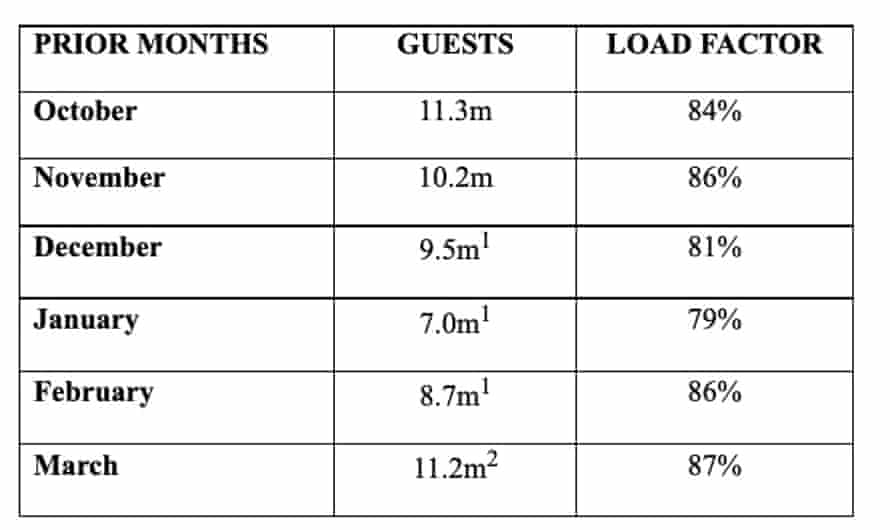

Ryanair also reported that it carried 11.2 million passengers in March, up from 8.7m in February, although the Ukraine war did knock customer numbers.

It’s the highest monthly total since last October (before the Omicron variant led to travel restrictions).

It’s also above pre-pandemic levels. Ryanair carried 10.9 million in March 2019, which fell to 5.5m in March 2020 and just 500,000 in March 2021.

Ryanair adds:

March traffic was impacted by the Russian invasion of Ukraine which caused 2,000 flights to/from Ukraine to be cancelled in March due to airspace closures.

Ryanair says full-year traffic recovered strongly to over 97m, up from 27.5m the year before, but only two-thirds of its pre-Covid traffic of 149m.

EasyJet cancelled more than 200 flights over the weekend, as rising Covid-19 infections led to a rise in staff absences.

Disruption is expected to last into this week, leaving some passengers stranded amid travel chaos at some of Britain’s biggest airports.

The airline blamed the problems on high levels of sickness among employees caused by Covid, with at least 222 trips axed since Friday.

It said it had made efforts to offset staff shortages by rostering additional standby crew on the weekend but was forced to make “additional cancellations for [Sunday] and [Monday]”.

A total of 62 flights scheduled for Monday have been pulled, most of which were announced at short notice on Saturday.

An easyJet spokesperson said:

“As a result of the current high rates of Covid infections across Europe, like all businesses easyJet is experiencing higher than usual levels of employee sickness.

“We have made 62 pre-emptive cancellations for flights to and from the UK for [Monday] which represents a small proportion of [Monday’s] total flying programme which was planned to be more than 1,645 flights. We cancelled the majority of these [on Saturday].”

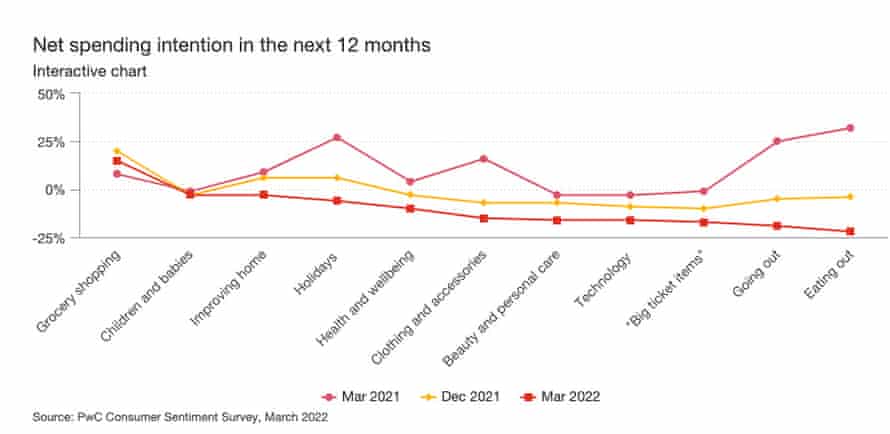

UK consumers are cutting back on discretionary spending, as rising food bills leave them with less money for other

Spending expectations for eating out, going out, holidays and fashion spending have all fallen this year, PwC’s consumer confidence report shows.

Grocery is now the only category with a net positive spending intention; almost exclusively due to inflation expectations.

PwC says:

Spending expectations on eating out and going out have plummeted; they are now the lowest categories as consumers look for ways to tighten their spending. Eating out, in particular, had an excellent post-lockdown rebound, with the Coffer CGA Business Tracker showing high single digit like-for-like growth in chain restaurant sales compared with 2019 throughout Autumn and into early 2022. The only exceptions to this were at the height of Omicron and working-from-home guidance issued in December 2021 and January 2022.

Other discretionary spending should expect to be hit hard, with holidays and fashion spending intentions also seeing substantial falls since last Spring. Pent-up demand and weak comparatives may mean that both categories should see double-digit growth compared with 2021, but neither is expected to reach pre-pandemic heights.

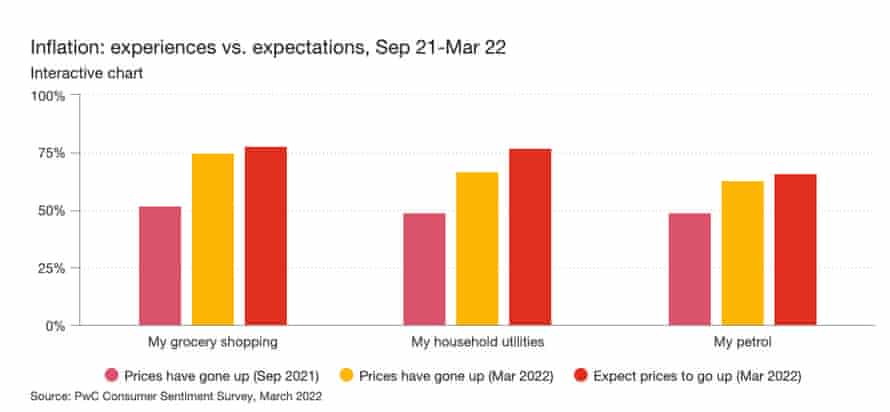

Consumers are bracing for prices to continue climbing in the coming months.

Three quarters of people surveyed by PwC last month had seen their grocery shopping become more expensive in the past few months, and 78% expect prices will rise further in the coming months.

It’s a similar picture with utilities – two-thirds were already spending more, with 77% expecting further rises. Just 4% of all consumers do not expect to increase spending on either groceries, utilities or petrol in the coming months.

UK inflation hit a 30-year high of 6.2% in February, and is expected to rise over 8% this month due to last Friday’s rise in the energy price cap.

Introduction: UK consumer confidence hammered by cost of living

Good morning, and welcome to our live rolling coverage of business, economics and financial markets.

The cost of living crisis has knocked UK consumer confidence down to its lowest level since the pandemic, as rising food and energy bills hammer families.

There has been a “significant and sustained drop-off in consumer sentiment”, leading to the biggest one-year drop in confidence since the global financial crisis, a new report from PwC this morning shows.

Its index of UK consumer confidence has dropped to -20 this month, from +10 last summer. That’s barely above the -26 recorded at the start of the pandemic two years ago.

PwC warns that this dramatic drop shows the impact that the cost of living crisis is having across the UK.

Lisa Hooker, Leader of Industry for Consumer Markets, PwC UK, says:

“This shift in sentiment is both significant and sudden, with consumer spending expectations moving towards more essential areas at the expense of discretionary items. Businesses that help customers by offering them the options to trade down are more likely to keep their loyalty for when things get better.”

The 30-point drop over the last nine months is the biggest sustained decline in PwC’s survey since the 2008 Global Financial Crisis, as households face the biggest squeeze in in decaces.

Energy bills have just soared, and could do so again in October, while food price inflation is the fastest in 10 years.

More details to follow…..

Also coming up today

Eurozone finance ministers will discuss the impact of the war in Ukraine on Europe’s economies when they hold a Eurogroup meeting today, as pressure grows for a ban on imports of Russian gas.

They will also discuss how a digital euro could be designed, and the trade-offs between privacy and preventing money laundering, illicit financing and tax evasion.

European stock markets have opened a little higher, despite worries over rising inflation, slower growth and the impact of the Ukraine war.

The problems facing global equity markets remain constant – rampant inflation, soaring energy prices, higher taxes & geopolitical fallout. Oil $104. Asia buoyant on tech. Suggested opening calls calm & reflective. FTSE +36 @ 7573 DAX +30 @ 14476 CAC +12 at 6696 DJIA unch at 34818

— David Buik (@truemagic68) April 4, 2022

The agenda

- 7am BST: German trade balance for February

- 10.05am BST: Bank of England governor Andrew Bailey: Speech at the Stop Scams Conference

- From 2pm BST: Eurogroup meeting of eurozone finance ministers in Luxembourg.

- 3pm BST: Bank of England deputy governor Sir Jon Cunliffe speech at a European Economics & Financial Centre seminar

- 3pm BST: US factory orders for February

www.theguardian.com

George is Digismak’s reported cum editor with 13 years of experience in Journalism