Mathieu Young/Getty Images

Americans traveling to Europe can do so a bit more cheaply these days than in recent years.

The US dollar is trading at its highest level in roughly two decades relative to the euro — meaning travelers can buy more overseas.

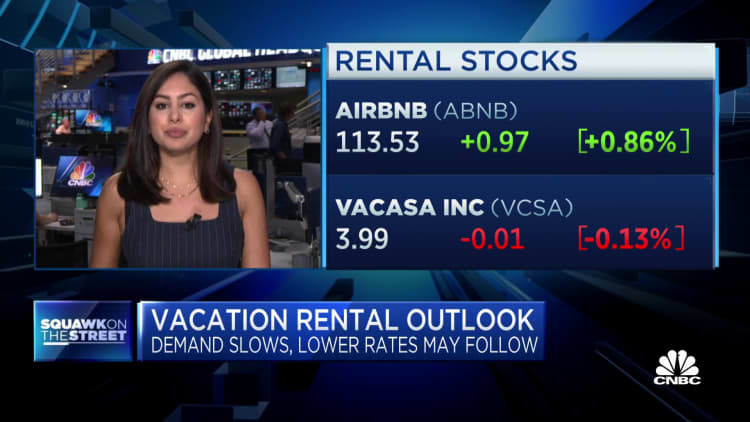

related investing news

That means Americans are effectively getting a discount on hotels, car rentals, tours, and other goods and services denominated in euros. And it’s not just the euro — the dollar’s value is at its strongest in years relative to many other foreign currencies, too, according to travel experts.

More from Personal Finance:

You may qualify for over $10,000 in climate incentives from Inflation Reduction Act

How student loan forgiveness could affect your credit score

67% of pandemic ‘boomerang kids’ are still living with mom and dad

It’s unclear how long the good times will last. Some may wonder: Should I act now to lock in a favorable exchange rate?

“I’d pull the trigger now,” Aiden Freeborn, senior editor at travel site The Broke Backpackertold CNBC.

“You could hedge and wait to see if things improve, but that could backfire,” he added. “Don’t be too greedy; accept the fact this is a very strong position.”

Here’s what to know and how to take advantage.

Americans are getting a 16% discount

Louis Alvarez | digitalvision | Getty Images

Just how much of a discount are travelers getting right now? Let’s look at the euro as an example.

The euro is the official currency for 19 of the 27 European Union members: Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, the Netherlands, Portugal, Slovakia, Slovenia and Spain.

The euro has been falling in value relative to the US dollar for more than a year. It hit parity with the US dollar on July 13 — the first time since 2002 — meaning the two currencies had a 1:1 exchange rate.

Since then, the euro has dropped further. One US dollar bought nearly 1.01 euros as of the market close Monday. Americans are getting a roughly 16% discount from a year ago.

“The exchange rate right now is ridiculous,” Charlie Leocha, chairman of Travelers United, an advocacy group, has told CNBC. “It makes everything in Europe that used to be expensive not that expensive.”

But the dollar’s strength is broader than just the euro.

For example, the Nominal Broad US Dollar Index gauges the dollar’s appreciation relative to currencies of the US’ main trading partners, like the Canadian dollar, British pound, Mexican peso and Japanese yen in addition to the euro. It’s up more than 8% in the last year.

Further, since July, the index has hovered near its highest point dating to at least 1973, according to Andrew Hunter, senior US economist at Capital Economics. There’s one exception: the period from March to May 2020, when international travel was largely inaccessible due to the Covid-19 pandemic.

“I think the big picture is, now is probably a good time to go abroad,” Hunter said. “Now is a good time to buy foreign currency, basically.”

Why the US dollar is stronger

Matteo Colombo | Moment | Getty Images

The strength of the dollar is attributable to a few factors, Hunter said.

Perhaps the most consequential is the US Federal Reserve’s campaign to raise interest rates. The central bank has been more aggressive than others around the world in increasing borrowing costs; the dynamic creates an incentive for international investors to keep funds in dollar-based assets since they can generally earn a higher return, Hunter said.

Recently, soaring natural gas prices have contributed to an “increasingly bleak” economic outlook in Europe, Hunter said. Meanwhile, natural gas prices have been broadly stable in the US, where the main trend is instead the continued sharp fall in gasoline prices, he added.

Earlier this year, surging oil prices had hurt growth prospects for some developed countries (especially in Europe) relative to the US And economic uncertainty (due to factors like inflation and recession fears and the war in Ukraine) has led investors to flock to safe haven assets like the US dollar.

“Further gains in the dollar if they materialize are still likely to be relatively small compared to the rise we’ve already seen,” Hunter said. “But there’s maybe a bit more scope for further dollar appreciation now than we previously thought.”

Of course, currency moves are notoriously difficult to predict, he said.

The European Central Bank also increased interest rates in July, for the first time in 11 years. So far, that doesn’t seem to have impacted the strength of the US dollar relative to the euro, Freeborn said.

“But it does signal that the ECB is now taking action,” he said. “As such it may only be a matter of time before the euro starts to rise against the dollar — so now really is the time to travel.”

Pay in advance to lock in low exchange rates

Of course, this isn’t all to say Americans will necessarily reap financial rewards the world over.

But tourists planning or considering a trip to a country where the dollar is historically strong can lock in that favorable exchange rate by booking a hotel, rental car or other service today instead of deferring the cost, according to travel experts.

This is especially worthwhile for those with a trip at least three months away, Leocha said.

“You can pay in advance, and sometimes you get a discount for paying in advance — so you get a discount and the low exchange rate,” he said.

Be aware: In some cases, you may owe an additional foreign transaction fee for a credit card purchase overseas. Some travel cards eliminate these fees, though, which generally amount to 3% of the purchase price, Leocha said.

Fees may depend on where the company you’re transacting with is based. There isn’t a foreign transaction fee if the purchase is through a third-party US entity like Expedia, but there often is one if booked directly through a foreign entity like the actual hotel, Leocha said.

When to convert cash for a trip abroad

Travelers can also convert cash ahead of a trip but should generally only do so if the trip is several months away, according to travel experts.

That’s because providers like banks typically offer less generous exchange rates — meaning a customer may be better served by waiting until arriving at their destination country and making purchases with a credit card, especially if it doesn’t carry a foreign transaction fee.

While abroad, merchants may offer travelers the choice of making a purchase “with or without conversion” or according to some similarly worded prompt. travelers should decline that conversion offer—meaning they should opt to do the transaction in the destination currency instead of convert that price into dollars—in order to get the best exchange rate, experts said.

Travelers who’d prefer to convert to cash can hedge their exchange rate bets by converting half their estimated expenditure now and waiting until later (or their arrival) to cover the rest, Freeborn said.

Correction: The Nominal Broad US Dollar Index is up more than 8% in the last year. An earlier version misstated the percentage.

www.cnbc.com

George is Digismak’s reported cum editor with 13 years of experience in Journalism