AppleInsider is supported by your audience and can earn commissions as an Amazon Associate and Affiliate Partner on qualifying purchases. These affiliate associations do not influence our editorial content.

Apple has released its crucial 2021 holiday quarter results, breaking all company records for the quarter. Here are some interesting notes from the report, including comments from Apple CEO Tim Cook and CFO Luca Maestri.

Apple’s first calendar quarter 2022 results

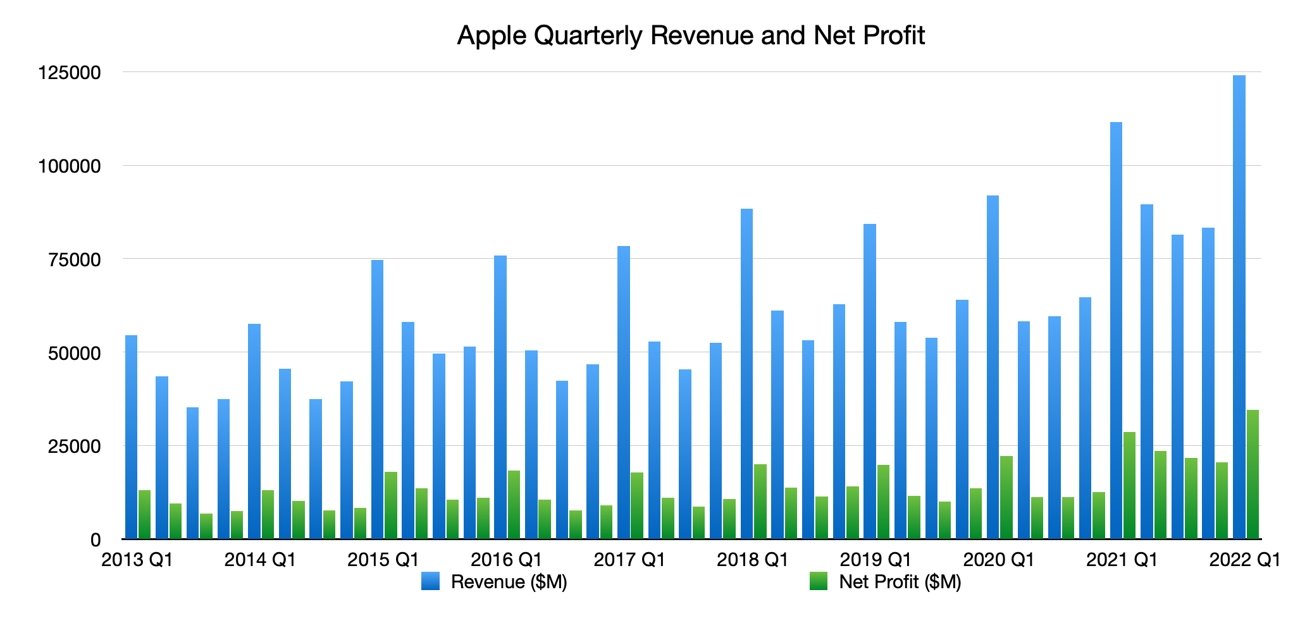

Announced Thursday before Apple’s usual analyst call, Apple’s revenue of $123.9 for the quarter ending December 2021 is equal to year-over-year growth/decline from the record $111.4B reported in the quarter of the previous year. Apple’s earnings per share were $2.10 for the quarter, compared to $1.68 for the first quarter of 2021 results.

The results for the quarter follow from the excellent $83.4 billion in revenue seen in the fourth quarter of 2020.

The Wall Street consensus for the quarter predicted that Apple would report revenue of $118.3 billion and EPS of $1.89 for the first quarter of 2022.

Releases from the previous quarter also contribute heavily to Apple’s revenue, with Q1 being the first full quarter of availability for them. This includes the main generation iPhone 13, as well as the 9th generation iPad and 6th generation iPad mini.

In the quarter, iPhone net sales increased to $71.6 billion, up from $65.6 billion in the same quarter a year earlier. Mac sales rose by more than $2.2 billion to $10.8 billion, while iPad sales fell about $1.2 billion to $7.2 billion due to supply constraints.

Apple’s fiscal first quarter 2022 revenue and net profit

Apple’s wearables segment rose to $14.7 billion from $13.0 billion in the prior year quarter. Services rose about $3.8 billion from 2020 to $19.5 billion in the 2021 holiday quarter.

“This quarter’s record results were made possible by our most innovative lineup of products and services,” said Tim Cook, Apple’s CEO. “We’re pleased to see the response from customers around the world at a time when staying connected has never been more important.”

“The strong customer response to our recent launch of new products and services drove double-digit growth in revenue and earnings, and helped set an all-time record for our installed base of active devices,” said Luca Maestri, CFO of Manzana. “These record operating results enabled us to return nearly $27 billion to our shareholders during the quarter, while maintaining our goal of reaching a net cash neutral position over time.”

AppleInsider interpretations of results and observations are initialed at the end of the statement. This is updated live, update often for the latest sightings.

Highlights of the earnings report and the following conference call

- Apple shares started the day at $162.45, after a tumultuous week following the $3 billion valuation milestone.

- Apple shares are down 12.4% for the year.

- Right after the earnings report, Apple shares are up over $160 and are at $162.20 as of 4:35 p.m. ET.

- The analyst pullback has already begun. We’ll talk more about this when the dust settles — MW

- At 5:00 p.m. ET, AAPL reached $167.21

- Tim Cook: 1.8 billion devices in active use

- Tim Cook: Supply constraints in the holiday quarter were worse than in the previous quarter

- Tim Cook: App Store is an “economic miracle” with $260 billion paid out. 2021 was a new record for developer earnings

- “We saw supply constraints on most of our products,” Cook said in an interview with the Wall Street Journal “We are forecasting that we will be less [constrained] in March than we were in the December quarter.

- Luca Maestri: “The vast majority” of Mac sales are Apple Silicon (obviously – MW)

- Half of iPad buyers are new to the product

- Apple Watch saw about 2/3 of customers buy in the quarter new to the product

- Paid subscriptions grew to more than 785 million in total, 165 million more in the last 12 months

- $14.4 billion spent in the quarter on 93 million Apple shares, with 30 million shares retired

- An income guide is not being issued

- Record revenue is expected in the March quarter, although the growth rate will slow from the previous quarter

- Challenging comparison, channel fill time and currency headwinds cited

- Apple earned 10% more in the holiday quarter than in all of 2011 — MO

- Question and answer time!

- Wamsi Mohan – Bank of America – Impressive Margins, How Sustainable iPhone Pro/Pro Max Mix and Service Mix Trends Are

- Cook: “Strong demand throughout the iPhone 13 family”; no comment on a particular combination (as always, MW)

- Maestri: No real comment on the mix of products or services as far as margins are concerned, except that as we grow we make more money (again, as usual, MW)

- Kyle McNealy – Jefferies – Do we expect an iPad recovery as component supply increases?

- Cook: Repeats comment about March quarter being less constrained

- Cook: Challenge On Legacy Nodes, Limited By Vendor (October Earnings Replay – MW)

- McNealy: wants more trajectory information

- Cook repeats the limitations of legacy nodes. Repeat that Apple does not guide by volume

- Shannon Cross – Cross Research – Wants more color in Mac sales

- Cook: You’re seeing revenue growth on the Mac, not limited to a narrow geographic area. Excellent consumer response for MacBook Pro

- Cook: Six out of 10 sales in China are new to the Mac.

- Cross: What were the things that performed best in Services?

- Maestri: Great on all fronts. All-time records for video, music, cloud, payments, App Store

- Maestri: Spread all over the world

- The first quarter of 2022 generated more revenue than the sum of fiscal year 1997 to fiscal year 2007. – MO

- Katy Huberty – Morgan Stanley: Is Apple starting to rethink the manufacturing footprint in the wake of disruption?

- Cook: The biggest problem by far is the shortage of chips. Legacy and industry-wide nodes.

- Huberty – Metaverse Opportunity?

- Cook: Always exploring new opportunities. Over 14,000 ARKit apps on the App Store now. Lots of potential in space.

- Cook never said the word Metaverse – MW

- Amit Daryanani – Evercore – How much revenue is left on the table in December?

- Cook: Difficult to estimate with great precision. He repeats that March will be less constrained than December.

- Cook: Still a challenging environment.

- Daryanani: How does Apple decide where to spend R&D funds?

- Cook: We try to announce things when they’re ready, keep the element of surprise.

- Cook: Other people can do it differently, of course.

- Cook: We look at things that are at the intersection of hardware, software, and services.

- Samik Chatterjee: JP Morgan – Apple TV+, what trends do you see and how similar are they to the rest of the market?

- Cook: We don’t give Apple TV+ subscriber numbers

- Cook: Cook repeats numbers of wins and nominations for Apple TV +. Doing exactly what we wanted.

- Chatterjee: Where are the biggest service opportunities?

- Cook: Apple Card. Cite customer satisfaction and the main use of the card

- Chris Kaso – Raymond James – Question again about next quarter

- Maestri: Repeat the comments about the record quarter.

- Kaso: growth sustainability on the iPhone?

- Cook: The iPhone is an integral part of many people’s lives. Repeats active device usage numbers.

- Cook: Repeat the customer satisfaction numbers. (Some analysts should pay more attention to what has already been said – MW)

- Cook: “We maintain a very optimistic view of the iPhone in the long term”

- Ben Bollin – Cleveland Research: iPhone User Base and Parallel Subscription Numbers?

- Maestri: Points out the obvious relationship between the number of users and subscription volumes and dollars

- Harsh Kumar – Piper Sandler: Apple TV+ Content – In essence, what is Apple’s philosophy on content acquisition

- Cook: We try to find good content that has a reason for being

- Cook: “I don’t see that we’ve narrowed down our universe of things that we’re selecting. There’s a lot to choose from.”

- Kumar: Apple’s vision of health care in the future. Will Apple play a more active role in health care and mandates?

- Cook: Repeat a bit about the health alerts and the 911 call from earlier in the call.

appleinsider.com

George is Digismak’s reported cum editor with 13 years of experience in Journalism