Introduction: Pound at 37-year low against dollar as Bank of England decision looms

Good morning, and welcome to our rolling coverage of business, the world economy and the financial markets.

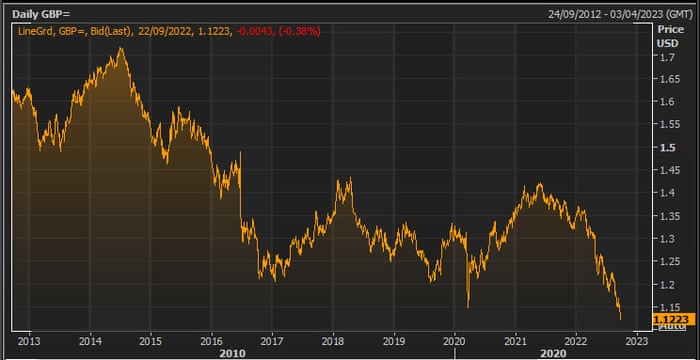

A plethora of problems have sent sterling sliding to a new 37-year low against the US dollar, ahead of a crunch Bank of England interest rate decision.

The pound has dropped to $1.123 this morning, the lowest since 1985, extending its recent slump – it’s now down almost 17% so far this year.

It lost more ground against the rampant dollar after America’s Federal Reserve delivered its third hefty interest rate rise in a row last night, lifting rates by another 75 basis points (three-quarters of a percent).

Anxiety about Vladimir Putin’s threat of nuclear retaliation against the West are hitting the markets.

UK assets are also being weighed down by concerns over Liz Truss’s push for unfunded tax cuts and spending pledges such as yesterday’s energy price cap for non-domestic users, which will add to borrowing.

Yesterday’s August public finances, showing the UK borrowed almost twice as much as expected, has added to the pressure.

Cost to taxpayer of Truss’s £100bn energy package has escaped scrutiny – but could that be harmful in the long run? https://t.co/1QFuvhivhp

— Jessica Elgot (@jessicaelgot) September 21, 2022

n”,”url”:”https://twitter.com/jessicaelgot/status/1572656470394798080″,”id”:”1572656470394798080″,”hasMedia”:false,”role”:”inline”,”isThirdPartyTracking”:false,”source”:”Twitter”,”elementId”:”10b2a0ac-58d5-4a7f-814f-c6f8f18593e7″}}”/>

Fed chair Jerome Powell rattled investors last night by insisting, again, that his central bank would keep tightening rates to push down inflation, and wouldn’t rule out a recession.

Powell warned:

We have always understood that restoring price stability while achieving a relatively modest increase in unemployment and a soft landing would be very challenging.

And we don’t know. No one knows whether this process will lead to a recession or if so, how significant that recession would be.”

This drove investors into the dollar, which has hit two-decade highs against the euro and the yen this morning too.

*Sterling Falls To 37-Year Low Of $1.1225

*Euro Falls To Two-Decade Low Of $0.9807

— *seven (@sevenloI) September 22, 2022

n”,”url”:”https://twitter.com/sevenloI/status/1572754955965972481″,”id”:”1572754955965972481″,”hasMedia”:false,”role”:”inline”,”isThirdPartyTracking”:false,”source”:”Twitter”,”elementId”:”f9b94b78-2158-4d52-9017-c06c1502342e”}}”>

*Sterling Falls To 37-Year Low Of $1.1225

*Euro Falls To Two-Decade Low Of $0.9807

— *seven (@sevenloI) September 22, 2022

But will the Bank of England deliver a hawkish rate hike too?

The money markets say there’s roughly an 90% chance that the BoE will raise Bank Rate by 75 basis points at noon today, to 2.5%, as it tried to tame inflation.

That would be its biggest raise increase since 1989, and take borrowing costs to their highest levels since late 2008.

But some economists think the Bank might ‘only’ raise rates by another half a percent, repeating last month’s move (which was the biggest rise since 1995).

Policymakers may want to see the impact of the government’s energy bill freeze, which is likely to prevent inflation soaring as much as feared in the short term – while also adding to price pressure further ahead.

The Bank could also announce the start of ‘quantitative tightening’, cutting back its holding of UK government debt bought during the financial crisis, and the pandemic.

Kallum Pickering, senior economist at Berenberg, suggests this might lead the Bank towards a half-point rate rise:

While 75bp is far from inconceivable, 50bp remains more likely, in our view. Remember, in addition to raising rates, the BoE looks set to announce the start of active selling gilts as part of its quantitative tightening policy.

As financial conditions are already tightening as benchmark rates edge ever higher, we believe the BoE will wait to see the impact of active QT before deciding on whether to steepen the trajectory of rate hikes.

A smaller hike could further weaken the pound. And either way, higher borrowing costs will add to the burden on consumers amid the cost of living squeeze.

It’s a busy day for monetary policy. Switzerland and Norway’s central banks are both setting interest rate today – with the Swiss National Bank expected to raise rates by 75bp, out of negative territory.

The agenda

-

8.30am BST: Swiss National Bank interest rate decision

-

9am BST: Norway’s Norges Bank interest rate decision

-

9.30am BST: ONS’s economic activity and business insights data on UK economy

-

12pm BST: Bank of England interest rate decision

-

1.30pm BST: US weekly jobless claims

-

2.15pm BST: Treasury Committee to scrutinise yesterday’s energy price cap announcement and look ahead to mini-budget

-

3pm BST: Eurozone consumer confidence flash estimate for September

“,”elementId”:”387df5bb-f11b-4488-9c06-5f5df5da90fc”},{“_type”:”model.dotcomrendering.pageElements.TextBlockElement”,”html”:”

In London, the FTSE 100 index has dropped 1%, or 71 points, to a three-week low of 7168 points.

“,”elementId”:”ccc35789-f102-42bb-acd6-c7b6989e86ec”},{“_type”:”model.dotcomrendering.pageElements.TextBlockElement”,”html”:”

Almost every share on the blue-chip index is lower, with investment companies, property firms and hotel groups among the fallers.

“,”elementId”:”15b02dc3-0914-4d38-abc0-a14c187d418c”},{“_type”:”model.dotcomrendering.pageElements.TextBlockElement”,”html”:”

Germany’s DAX and France’s CAC have both tumbled around 1.7%.

“,”elementId”:”4c34293c-9343-4b1e-8c9f-3b8f0bc49747″},{“_type”:”model.dotcomrendering.pageElements.TextBlockElement”,”html”:”

Fed chair Powell’s warning that there wasn’t a painless way to bring down inflation has heightened anxiety that the US will see weaker growth and higher unemployment, hurting the global economy too.

“,”elementId”:”86c19041-a375-47ae-a496-ade363fcb390″},{“_type”:”model.dotcomrendering.pageElements.TextBlockElement”,”html”:”

Carl Riccadonna, US Chief Economist at BNP Paribas Markets 360, says:

“,”elementId”:”7312565b-49cd-49ef-80c1-34ec4bdbb423″},{“_type”:”model.dotcomrendering.pageElements.BlockquoteBlockElement”,”html”:”

n

The Fed announced a unanimous 75bp hike, coupled with a more hawkish dot plot and Jackson Hole-like press conference in which Chair Powell reiterated the central bank’s commitment to restoring price stability.

n

Powell specifically stated: “Without price stability, the economy does not work for anyone.”

n

He concluded by adamantly assuring that regardless of the exact trajectory of interest rates, the Fed is determined to do “enough to restore price stability.”

n

“,”elementId”:”221f890c-3489-43fa-ad83-0ea87844523b”},{“_type”:”model.dotcomrendering.pageElements.TweetBlockElement”,”html”:”

Apertura mercados europeos:

🇩🇪 DAX 🔻 -1,18%

🇪🇺 EuroStoxx 🔻 -1,78%

🇬🇧 FTSE 🔻 -0,99%

🇫🇷 CAC 🔻 -1,62%

🇮🇹 FTSE MIB 🔻 -1,40%https://t.co/S6BlqjZDk3

— Radio Intereconomía (@rintereconomia) September 22, 2022

n”,”url”:”https://twitter.com/rintereconomia/status/1572844447838224385″,”id”:”1572844447838224385″,”hasMedia”:false,”role”:”inline”,”isThirdPartyTracking”:false,”source”:”Twitter”,”elementId”:”24c3ab57-b70a-49a7-a867-5c4f5e6f814a”},{“_type”:”model.dotcomrendering.pageElements.TextBlockElement”,”html”:”

South Korea’s KOSPI has dropped 1%, while Australia’s S&P/ASX 200 has lost 1.5%.

“,”elementId”:”fa1b266f-6073-4d0e-b414-4536ae0e6ca5″}],”attributes”:{“pinned”:false,”keyEvent”:true,”summary”:false},”blockCreatedOn”:1663831104000,”blockCreatedOnDisplay”:”08.18 BST”,”blockLastUpdated”:1663831789000,”blockLastUpdatedDisplay”:”08.29 BST”,”blockFirstPublished”:1663831789000,”blockFirstPublishedDisplay”:”08.29 BST”,”blockFirstPublishedDisplayNoTimezone”:”08.29″,”contributors”:[],”primaryDateLine”:”Thu 22 Sep 2022 08.29 BST”,”secondaryDateLine”:”First published on Thu 22 Sep 2022 07.51 BST”},{“id”:”632c08508f08146227061de6″,”elements”:[{“_type”:”model.dotcomrendering.pageElements.TextBlockElement”,”html”:”

The Bank of England would hit millions of households more than £3bn in extra mortgage costs if it raises interest rates by 75 basis points (three-quarters of a percent) today.

“,”elementId”:”55dbdcbd-3895-48d5-a194-0e22681f35c4″},{“_type”:”model.dotcomrendering.pageElements.TextBlockElement”,”html”:”

Analysts say the biggest rate hike for more than three decades – which could come at noon – would mean an extra £3.1bn of interest payments for borrowers on standard variable rate and tracker mortgages.

“,”elementId”:”cade7357-1161-41cb-8cbb-b5725d2df3d0″},{“_type”:”model.dotcomrendering.pageElements.TextBlockElement”,”html”:”

Sarah Coles, senior personal finance analyst at Hargreaves Lansdown, said:

“,”elementId”:”155b323a-b160-4b8a-be17-035c52b77c42″},{“_type”:”model.dotcomrendering.pageElements.BlockquoteBlockElement”,”html”:”

n

“For anyone who is already struggling with runaway price rises, the extra cost of the mortgage could be the final straw.”

n

“,”elementId”:”79ea1d61-5e4d-412f-b58d-aec94ebc99e9″},{“_type”:”model.dotcomrendering.pageElements.TextBlockElement”,”html”:”

The investment firm said three-quarters of mortgage holders are on fixed rates, meaning they would not see an immediate impact, but that more than 2 million borrowers are on standard variable rates or trackers.

“,”elementId”:”3762d0a0-6e15-43af-8516-ab02082c4000″},{“_type”:”model.dotcomrendering.pageElements.TextBlockElement”,”html”:”

For the average UK property, with a 75% loan-to-value-mortgage, an increase of 0.75 percentage points would mean a £78 jump in monthly interest payments, according to estimates by TotallyMoney.

“,”elementId”:”a2b9361d-dac0-486d-a7c0-f5c57151b2d0″},{“_type”:”model.dotcomrendering.pageElements.TextBlockElement”,”html”:”

Fixed-rate deals are due to expire for as many as 3.2 million borrowers within the next two years.

“,”elementId”:”19129dfe-f563-4f3e-b96e-2e87d7dade13″},{“_type”:”model.dotcomrendering.pageElements.TextBlockElement”,”html”:”

Here’s the full story:

“,”elementId”:”38da86ee-4e91-437b-b8b1-cfa35df71324″},{“_type”:”model.dotcomrendering.pageElements.RichLinkBlockElement”,”url”:”https://www.theguardian.com/business/2022/sep/21/bank-of-england-may-tackle-inflation-with-major-interest-rate-hike”,”text”:”UK households face £3bn hit if Bank goes ahead with 0.75-points rate rise”,”prefix”:”Related: “,”role”:”thumbnail”,”elementId”:”8b96afbf-4469-4672-becf-a1bdd2b2868e”}],”attributes”:{“pinned”:false,”keyEvent”:true,”summary”:false},”blockCreatedOn”:1663830096000,”blockCreatedOnDisplay”:”08.01 BST”,”blockLastUpdated”:1663830486000,”blockLastUpdatedDisplay”:”08.08 BST”,”blockFirstPublished”:1663830486000,”blockFirstPublishedDisplay”:”08.08 BST”,”blockFirstPublishedDisplayNoTimezone”:”08.08″,”title”:”UK households face £3bn hit if Bank goes ahead with 0.75-points rate rise”,”contributors”:[{“name”:”Richard Partington”,”imageUrl”:”https://i.guim.co.uk/img/uploads/2017/12/27/Richard-Partington.jpg?width=300&quality=85&auto=format&fit=max&s=7a0cd4e01f7289ba75909509b7b8da7c”,”largeImageUrl”:”https://i.guim.co.uk/img/uploads/2017/12/27/Richard_Partington,_R.png?width=300&quality=85&auto=format&fit=max&s=bb38e72cdfabfe7563b4036c49593334″}],”primaryDateLine”:”Thu 22 Sep 2022 08.29 BST”,”secondaryDateLine”:”First published on Thu 22 Sep 2022 07.51 BST”},{“id”:”632c065d8f089a550b8aa3a5″,”elements”:[{“_type”:”model.dotcomrendering.pageElements.TextBlockElement”,”html”:”

Concerns that chancellor Kwasi Kwargeng could put the UK public finances on an “unsustainable path” in his mini-Budget on Friday won’t help the pound either.

“,”elementId”:”533e849b-d0c2-4209-abbb-dc0695f9af19″},{“_type”:”model.dotcomrendering.pageElements.TextBlockElement”,”html”:”

Last night, the respected Institute for Fiscal Studies warned that the government’s planned sweeping tax cuts, at a time of weak economic growth, could leave a £60bn per year hole in the public finances.

“,”elementId”:”ac4e05fa-e3c2-4669-98c2-6be7430eb73e”},{“_type”:”model.dotcomrendering.pageElements.TextBlockElement”,”html”:”

The IFS, in a joint report with Citi, fears that Liz Truss’s government is “choosing to ramp up borrowing just as it becomes more expensive to do so, in a gamble on growth that may not pay off.”

“,”elementId”:”77c6ca8c-4c88-4327-b094-e7a77b7c7f86″},{“_type”:”model.dotcomrendering.pageElements.TweetBlockElement”,”html”:”

Even once the substantial Energy Price Guarantee has expired in October 2024, borrowing could still run at about £100 billion a year in the mid-2020s.

This is more than £60 billion a year higher than the @OBR_uk forecast in March.

[6/13] pic.twitter.com/iZNk5dKQxw

— Institute for Fiscal Studies (@TheIFS) September 21, 2022

n”,”url”:”https://twitter.com/TheIFS/status/1572632518570004480″,”id”:”1572632518570004480″,”hasMedia”:false,”role”:”inline”,”isThirdPartyTracking”:false,”source”:”Twitter”,”elementId”:”5fe4baae-e419-4315-b810-1e2089c9b710″},{“_type”:”model.dotcomrendering.pageElements.TextBlockElement”,”html”:”

My colleague Phillip Inman explains:

“,”elementId”:”2d83bad1-c1d8-44df-8ebd-2fe61fb7d55b”},{“_type”:”model.dotcomrendering.pageElements.TextBlockElement”,”html”:”

Fuelling concerns that the UK’s precarious financial position will spark a run on the pound, the chancellor, Kwasi Kwarteng, is expected to reverse an increase in national insurance payments and cut corporation tax at a cost to the Treasury of £30bn.

“,”elementId”:”67f79e6d-421b-4375-805b-a71b4fa5ff44″},{“_type”:”model.dotcomrendering.pageElements.TextBlockElement”,”html”:”

Kwarteng, who will announce a review of his fiscal rules to allow the government to borrow more, is also expected to give away billions of pounds by cutting stamp duty on house purchases and confirm a multibillion-pound rise in the defence budget to support the war in Ukraine and boost growth

“,”elementId”:”9b602191-5656-4492-84d6-852f3a75f68d”},{“_type”:”model.dotcomrendering.pageElements.TextBlockElement”,”html”:”

These measures will be in addition to a freeze on energy prices for consumers and businesses that could cost more than £150bn over two years.

“,”elementId”:”dc470e33-0765-4e7f-8063-d829bee08041″},{“_type”:”model.dotcomrendering.pageElements.TextBlockElement”,”html”:”

The IFS report said:

“,”elementId”:”5c9a3c41-795d-4375-ae3a-9a8091453d9d”},{“_type”:”model.dotcomrendering.pageElements.BlockquoteBlockElement”,”html”:”

n

“Recent rapid increases in the cost of debt interest highlight the risks of substantially and permanently increasing borrowing and putting debt on an ever-increasing path.”

n

“There is no miracle cure, and setting plans underpinned by the idea that headline tax cuts will deliver a sustained boost to growth is a gamble, at best.”

n

“,”elementId”:”6e51bb10-86ce-41af-b838-4fb792c7e5d7″},{“_type”:”model.dotcomrendering.pageElements.TweetBlockElement”,”html”:”

Persistent current budget deficits and rising debt as a share of national income would mean that the two main fiscal targets legislated only in January would be missed.

Even once the Energy Price Guarantee has expired, debt would be left on an ever-increasing path.

[9/13] pic.twitter.com/UuSf6BpXMU— Institute for Fiscal Studies (@TheIFS) September 21, 2022

n”,”url”:”https://twitter.com/TheIFS/status/1572632526862024704″,”id”:”1572632526862024704″,”hasMedia”:false,”role”:”inline”,”isThirdPartyTracking”:false,”source”:”Twitter”,”elementId”:”f24ccb0a-3dfc-48cd-9cc4-2cf0319831c6″}],”attributes”:{“pinned”:false,”keyEvent”:true,”summary”:false},”blockCreatedOn”:1663829597000,”blockCreatedOnDisplay”:”07.53 BST”,”blockLastUpdated”:1663830058000,”blockLastUpdatedDisplay”:”08.00 BST”,”blockFirstPublished”:1663830058000,”blockFirstPublishedDisplay”:”08.00 BST”,”blockFirstPublishedDisplayNoTimezone”:”08.00″,”title”:”Mini-Budget risks setting UK on ‘unsustainable path’”,”contributors”:[],”primaryDateLine”:”Thu 22 Sep 2022 08.29 BST”,”secondaryDateLine”:”First published on Thu 22 Sep 2022 07.51 BST”},{“id”:”632bf52d8f08f4c4bf5d7cad”,”elements”:[{“_type”:”model.dotcomrendering.pageElements.TextBlockElement”,”html”:”

Good morning, and welcome to our rolling coverage of business, the world economy and the financial markets.

“,”elementId”:”467058f4-9173-47cc-b3ff-1f09bf585b31″},{“_type”:”model.dotcomrendering.pageElements.TextBlockElement”,”html”:”

A plethora of problems have sent sterling sliding to a new 37-year low against the US dollar, ahead of a crunch Bank of England interest rate decision.

“,”elementId”:”f832716f-60e0-4f34-86c6-c8859bba59e7″},{“_type”:”model.dotcomrendering.pageElements.TextBlockElement”,”html”:”

The pound has dropped to $1.123 this morning, the lowest since 1985, extending its recent slump – it’s now down almost 17% so far this year.

“,”elementId”:”72daef34-93ef-4d5d-bcdb-b4beb9ca94b9″},{“_type”:”model.dotcomrendering.pageElements.ImageBlockElement”,”media”:{“allImages”:[{“index”:0,”fields”:{“height”:”383″,”width”:”744″},”mediaType”:”Image”,”mimeType”:”image/jpeg”,”url”:”https://media.guim.co.uk/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/744.jpg”},{“index”:1,”fields”:{“isMaster”:”true”,”height”:”383″,”width”:”744″},”mediaType”:”Image”,”mimeType”:”image/jpeg”,”url”:”https://media.guim.co.uk/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg”},{“index”:2,”fields”:{“height”:”257″,”width”:”500″},”mediaType”:”Image”,”mimeType”:”image/jpeg”,”url”:”https://media.guim.co.uk/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/500.jpg”},{“index”:3,”fields”:{“height”:”72″,”width”:”140″},”mediaType”:”Image”,”mimeType”:”image/jpeg”,”url”:”https://media.guim.co.uk/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/140.jpg”}]},”data”:{“alt”:”The pound vs the US dollar over the last 20 years”,”caption”:”The pound vs the US dollar over the last 20 years”,”credit”:”Photograph: Refinitiv”},”displayCredit”:true,”role”:”inline”,”imageSources”:[{“weighting”:”inline”,”srcSet”:[{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=620&quality=85&auto=format&fit=max&s=cdd3cb40a40cdefed724ed3a83391c2d”,”width”:620},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=620&quality=45&auto=format&fit=max&dpr=2&s=15f59c4957549a3b79aa4532cc36f5b9″,”width”:1240},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=605&quality=85&auto=format&fit=max&s=d1e888343bfb5baa2ef3311bfad29d5c”,”width”:605},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=605&quality=45&auto=format&fit=max&dpr=2&s=9456c5439f23b632c5bbf251c4af8658″,”width”:1210},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=445&quality=85&auto=format&fit=max&s=224cb32f0c3eebcca1421fb036128a69″,”width”:445},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=445&quality=45&auto=format&fit=max&dpr=2&s=6688539c0ed2b3e829883af59ca98e8a”,”width”:890}]},{“weighting”:”thumbnail”,”srcSet”:[{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=140&quality=85&auto=format&fit=max&s=a48fbe21c214a625338ffcf15316bbb1″,”width”:140},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=140&quality=45&auto=format&fit=max&dpr=2&s=fd50705ebfb1f78fa4fb6c2b046cba3f”,”width”:280},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=120&quality=85&auto=format&fit=max&s=8658ff3ca5e8ec4bd75432919fc6d9a2″,”width”:120},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=120&quality=45&auto=format&fit=max&dpr=2&s=2791dd941b369ff1c87f721358fd94f3″,”width”:240}]},{“weighting”:”supporting”,”srcSet”:[{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=380&quality=85&auto=format&fit=max&s=5ccc8eaa702c67a21f573dcfbed6859e”,”width”:380},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=380&quality=45&auto=format&fit=max&dpr=2&s=a63e3986a3dff01e39e76755d157f5b1″,”width”:760},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=300&quality=85&auto=format&fit=max&s=7f1eb9290ad3cb406eef544fc0bf13a1″,”width”:300},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=300&quality=45&auto=format&fit=max&dpr=2&s=d14112c7f3701cfc549f9e77ce0af38e”,”width”:600},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=620&quality=85&auto=format&fit=max&s=cdd3cb40a40cdefed724ed3a83391c2d”,”width”:620},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=620&quality=45&auto=format&fit=max&dpr=2&s=15f59c4957549a3b79aa4532cc36f5b9″,”width”:1240},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=605&quality=85&auto=format&fit=max&s=d1e888343bfb5baa2ef3311bfad29d5c”,”width”:605},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=605&quality=45&auto=format&fit=max&dpr=2&s=9456c5439f23b632c5bbf251c4af8658″,”width”:1210},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=445&quality=85&auto=format&fit=max&s=224cb32f0c3eebcca1421fb036128a69″,”width”:445},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=445&quality=45&auto=format&fit=max&dpr=2&s=6688539c0ed2b3e829883af59ca98e8a”,”width”:890}]},{“weighting”:”showcase”,”srcSet”:[{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=860&quality=85&auto=format&fit=max&s=04ef87f38df40d1b5d92cb330b4d7595″,”width”:860},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=860&quality=45&auto=format&fit=max&dpr=2&s=072eee588bcd1b3024738ce1e129103d”,”width”:1720},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=780&quality=85&auto=format&fit=max&s=5acf7006302dc01e67520386ed9e6785″,”width”:780},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=780&quality=45&auto=format&fit=max&dpr=2&s=5cc91e89b16025602961fd9315140f07″,”width”:1560},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=620&quality=85&auto=format&fit=max&s=cdd3cb40a40cdefed724ed3a83391c2d”,”width”:620},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=620&quality=45&auto=format&fit=max&dpr=2&s=15f59c4957549a3b79aa4532cc36f5b9″,”width”:1240},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=605&quality=85&auto=format&fit=max&s=d1e888343bfb5baa2ef3311bfad29d5c”,”width”:605},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=605&quality=45&auto=format&fit=max&dpr=2&s=9456c5439f23b632c5bbf251c4af8658″,”width”:1210},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=445&quality=85&auto=format&fit=max&s=224cb32f0c3eebcca1421fb036128a69″,”width”:445},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=445&quality=45&auto=format&fit=max&dpr=2&s=6688539c0ed2b3e829883af59ca98e8a”,”width”:890}]},{“weighting”:”halfwidth”,”srcSet”:[{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=620&quality=85&auto=format&fit=max&s=cdd3cb40a40cdefed724ed3a83391c2d”,”width”:620},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=620&quality=45&auto=format&fit=max&dpr=2&s=15f59c4957549a3b79aa4532cc36f5b9″,”width”:1240},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=605&quality=85&auto=format&fit=max&s=d1e888343bfb5baa2ef3311bfad29d5c”,”width”:605},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=605&quality=45&auto=format&fit=max&dpr=2&s=9456c5439f23b632c5bbf251c4af8658″,”width”:1210},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=445&quality=85&auto=format&fit=max&s=224cb32f0c3eebcca1421fb036128a69″,”width”:445},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=445&quality=45&auto=format&fit=max&dpr=2&s=6688539c0ed2b3e829883af59ca98e8a”,”width”:890}]},{“weighting”:”immersive”,”srcSet”:[{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=1900&quality=85&auto=format&fit=max&s=2e897a01d070d889edc1c91475ed82c3″,”width”:1900},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=1900&quality=45&auto=format&fit=max&dpr=2&s=cfc1b78375651dca2db29cb427011262″,”width”:3800},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=1300&quality=85&auto=format&fit=max&s=48b5aa00d57ff9653ca3fce933238e33″,”width”:1300},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=1300&quality=45&auto=format&fit=max&dpr=2&s=e64505464bfb30a7e3ae6eafc0ab59d5″,”width”:2600},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=1140&quality=85&auto=format&fit=max&s=d3352fdfef668e5ca027763c6e63205e”,”width”:1140},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=1140&quality=45&auto=format&fit=max&dpr=2&s=f99dd0d70ad62e8d6c4f1c2eef4b1cdb”,”width”:2280},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=980&quality=85&auto=format&fit=max&s=99652bb168dc13daa62ae2817db7ed34″,”width”:980},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=980&quality=45&auto=format&fit=max&dpr=2&s=55682af9e29aa24a193c87be1cb5af4e”,”width”:1960},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=740&quality=85&auto=format&fit=max&s=363d0d79901096aba9b8af0501d70e36″,”width”:740},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=740&quality=45&auto=format&fit=max&dpr=2&s=d5fe400c8d6cc02481f58bdefddb3fad”,”width”:1480},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=660&quality=85&auto=format&fit=max&s=5043f7a910fb559e58e3d6fdf78a9277″,”width”:660},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=660&quality=45&auto=format&fit=max&dpr=2&s=9fd456a59f609e05ace9ef9461cf7ca1″,”width”:1320},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=480&quality=85&auto=format&fit=max&s=00cc7ade6f0f07f745c60d666e9698a3″,”width”:480},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=480&quality=45&auto=format&fit=max&dpr=2&s=c96c4d03bd88a408c2782c475391b455″,”width”:960}]}],”elementId”:”35a28257-38c5-4863-8c13-4890939982c8″},{“_type”:”model.dotcomrendering.pageElements.TextBlockElement”,”html”:”

It lost more ground against the rampant dollar after America’s Federal Reserve delivered its third hefty interest rate rise in a row last night, lifting rates by another 75 basis points (three-quarters of a percent).

“,”elementId”:”2c2f7fd1-1b84-4626-b20b-f93b449b6e29″},{“_type”:”model.dotcomrendering.pageElements.TextBlockElement”,”html”:”

Anxiety about Vladimir Putin’s threat of nuclear retaliation against the West are hitting the markets.

“,”elementId”:”450aa064-d9f2-4a1e-b2ae-cec6026ca051″},{“_type”:”model.dotcomrendering.pageElements.TextBlockElement”,”html”:”

UK assets are also being weighed down by concerns over Liz Truss’s push for unfunded tax cuts and spending pledges such as yesterday’s energy price cap for non-domestic users, which will add to borrowing.

“,”elementId”:”ecd9028c-4a4e-4d42-be67-a005266d9ad2″},{“_type”:”model.dotcomrendering.pageElements.TextBlockElement”,”html”:”

Yesterday’s August public finances, showing the UK borrowed almost twice as much as expected, has added to the pressure.

“,”elementId”:”c7a9cd40-cd22-4ea7-861d-bbd0a628b5ff”},{“_type”:”model.dotcomrendering.pageElements.TweetBlockElement”,”html”:”

Cost to taxpayer of Truss’s £100bn energy package has escaped scrutiny – but could that be harmful in the long run? https://t.co/1QFuvhivhp

— Jessica Elgot (@jessicaelgot) September 21, 2022

n”,”url”:”https://twitter.com/jessicaelgot/status/1572656470394798080″,”id”:”1572656470394798080″,”hasMedia”:false,”role”:”inline”,”isThirdPartyTracking”:false,”source”:”Twitter”,”elementId”:”534feed0-f7fc-497a-ba42-55f7e73a9b94″},{“_type”:”model.dotcomrendering.pageElements.TextBlockElement”,”html”:”

Fed chair Jerome Powell rattled investors last night by insisting, again, that his central bank would keep tightening rates to push down inflation, and wouldn’t rule out a recession.

“,”elementId”:”29d0e784-0a1b-49af-85a8-63eed74506c7″},{“_type”:”model.dotcomrendering.pageElements.TextBlockElement”,”html”:”

Powell warned:

“,”elementId”:”4ff17c4d-2744-4f11-9aad-26930b2f28d7″},{“_type”:”model.dotcomrendering.pageElements.BlockquoteBlockElement”,”html”:”

n

We have always understood that restoring price stability while achieving a relatively modest increase in unemployment and a soft landing would be very challenging.

n

And we don’t know. No one knows whether this process will lead to a recession or if so, how significant that recession would be.”

n

“,”elementId”:”a2c9c367-d525-4657-a8c3-26b04fd3d325″},{“_type”:”model.dotcomrendering.pageElements.RichLinkBlockElement”,”url”:”https://www.theguardian.com/business/2022/sep/21/fed-raises-interest-rates-third-increase-in-row”,”text”:”Fed raises interest rate by 0.75 percentage points as US seeks to rein in inflation”,”prefix”:”Related: “,”role”:”thumbnail”,”elementId”:”dfad2a33-c6e5-45c2-9ae3-7780dc5b5462″},{“_type”:”model.dotcomrendering.pageElements.TextBlockElement”,”html”:”

This drove investors into the dollar, which has hit two-decade highs against the euro and the yen this morning too.

“,”elementId”:”452ba526-e17a-481b-bde8-ba12ff4c2a1d”},{“_type”:”model.dotcomrendering.pageElements.TweetBlockElement”,”html”:”

*Sterling Falls To 37-Year Low Of $1.1225

*Euro Falls To Two-Decade Low Of $0.9807

— *seven (@sevenloI) September 22, 2022

n”,”url”:”https://twitter.com/sevenloI/status/1572754955965972481″,”id”:”1572754955965972481″,”hasMedia”:false,”role”:”inline”,”isThirdPartyTracking”:false,”source”:”Twitter”,”elementId”:”0335dda1-9b38-4fdc-9bcd-58fb4a3df77a”},{“_type”:”model.dotcomrendering.pageElements.TextBlockElement”,”html”:”

But will the Bank of England deliver a hawkish rate hike too?

“,”elementId”:”faea236d-e483-402d-bb00-a1a943c33568″},{“_type”:”model.dotcomrendering.pageElements.TextBlockElement”,”html”:”

The money markets say there’s roughly an 90% chance that the BoE will raise Bank Rate by 75 basis points at noon today, to 2.5%, as it tried to tame inflation.

“,”elementId”:”372fbc58-19fb-4bf2-b7ba-2bd56a068f52″},{“_type”:”model.dotcomrendering.pageElements.TextBlockElement”,”html”:”

That would be its biggest raise increase since 1989, and take borrowing costs to their highest levels since late 2008.

“,”elementId”:”70628b43-b798-4ca7-b4a4-05ccca855ac7″},{“_type”:”model.dotcomrendering.pageElements.TextBlockElement”,”html”:”

But some economists think the Bank might ‘only’ raise rates by another half a percent, repeating last month’s move (which was the biggest rise since 1995).

“,”elementId”:”6d32e675-50ae-404a-ba76-27e96120f704″},{“_type”:”model.dotcomrendering.pageElements.TextBlockElement”,”html”:”

Policymakers may want to see the impact of the government’s energy bill freeze, which is likely to prevent inflation soaring as much as feared in the short term – while also adding to price pressure further ahead.

“,”elementId”:”19728fd3-d3a9-4505-8e0d-61408c815f96″},{“_type”:”model.dotcomrendering.pageElements.TextBlockElement”,”html”:”

The Bank could also announce the start of ‘quantitative tightening’, cutting back its holding of UK government debt bought during the financial crisis, and the pandemic.

“,”elementId”:”3b1cb268-5322-4351-bca5-3f235ae5089b”},{“_type”:”model.dotcomrendering.pageElements.TextBlockElement”,”html”:”

Kallum Pickering, senior economist at Berenberg, suggests this might lead the Bank towards a half-point rate rise:

“,”elementId”:”0d9de0b9-8356-46c2-9090-1c6323b98976″},{“_type”:”model.dotcomrendering.pageElements.BlockquoteBlockElement”,”html”:”

n

While 75bp is far from inconceivable, 50bp remains more likely, in our view. Remember, in addition to raising rates, the BoE looks set to announce the start of active selling gilts as part of its quantitative tightening policy.

n

As financial conditions are already tightening as benchmark rates edge ever higher, we believe the BoE will wait to see the impact of active QT before deciding on whether to steepen the trajectory of rate hikes.

n

“,”elementId”:”105e96f2-70bc-4c0a-a91d-c1a89fcf2979″},{“_type”:”model.dotcomrendering.pageElements.TextBlockElement”,”html”:”

A smaller hike could further weaken the pound. And either way, higher borrowing costs will add to the burden on consumers amid the cost of living squeeze.

“,”elementId”:”ca650e32-5429-4805-9deb-07ac68a51279″},{“_type”:”model.dotcomrendering.pageElements.TextBlockElement”,”html”:”

It’s a busy day for monetary policy. Switzerland and Norway’s central banks are both setting interest rate today – with the Swiss National Bank expected to raise rates by 75bp, out of negative territory.

“,”elementId”:”9c44f217-2eb2-4465-83c5-8499e070e62a”},{“_type”:”model.dotcomrendering.pageElements.SubheadingBlockElement”,”html”:”

The agenda

“,”elementId”:”ec3ad1ff-f074-4bb8-b772-19c0ded3a10f”},{“_type”:”model.dotcomrendering.pageElements.TextBlockElement”,”html”:”

- n

-

8.30am BST: Swiss National Bank interest rate decision

-

9am BST: Norway’s Norges Bank interest rate decision

-

9.30am BST: ONS’s economic activity and business insights data on UK economy

-

12pm BST: Bank of England interest rate decision

-

1.30pm BST: US weekly jobless claims

-

2.15pm BST: Treasury Committee to scrutinise yesterday’s energy price cap announcement and look ahead to mini-budget

-

3pm BST: Eurozone consumer confidence flash estimate for September

n

n

n

n

n

n

n

“,”elementId”:”6ca0656c-7c7e-4d1a-8af0-999f8f1e5e7e”}],”attributes”:{“pinned”:true,”keyEvent”:true,”summary”:false},”blockCreatedOn”:1663829488000,”blockCreatedOnDisplay”:”07.51 BST”,”blockLastUpdated”:1663830726000,”blockLastUpdatedDisplay”:”08.12 BST”,”blockFirstPublished”:1663829488000,”blockFirstPublishedDisplay”:”07.51 BST”,”blockFirstPublishedDisplayNoTimezone”:”07.51″,”title”:”Introduction: Pound at 37-year low against dollar as Bank of England decision looms”,”contributors”:[],”primaryDateLine”:”Thu 22 Sep 2022 08.29 BST”,”secondaryDateLine”:”First published on Thu 22 Sep 2022 07.51 BST”}],”filterKeyEvents”:false,”format”:{“display”:0,”theme”:0,”design”:10},”id”:”key-events-carousel-mobile”}”>

Key events

“,”elementId”:”387df5bb-f11b-4488-9c06-5f5df5da90fc”},{“_type”:”model.dotcomrendering.pageElements.TextBlockElement”,”html”:”

In London, the FTSE 100 index has dropped 1%, or 71 points, to a three-week low of 7168 points.

“,”elementId”:”ccc35789-f102-42bb-acd6-c7b6989e86ec”},{“_type”:”model.dotcomrendering.pageElements.TextBlockElement”,”html”:”

Almost every share on the blue-chip index is lower, with investment companies, property firms and hotel groups among the fallers.

“,”elementId”:”15b02dc3-0914-4d38-abc0-a14c187d418c”},{“_type”:”model.dotcomrendering.pageElements.TextBlockElement”,”html”:”

Germany’s DAX and France’s CAC have both tumbled around 1.7%.

“,”elementId”:”4c34293c-9343-4b1e-8c9f-3b8f0bc49747″},{“_type”:”model.dotcomrendering.pageElements.TextBlockElement”,”html”:”

Fed chair Powell’s warning that there wasn’t a painless way to bring down inflation has heightened anxiety that the US will see weaker growth and higher unemployment, hurting the global economy too.

“,”elementId”:”86c19041-a375-47ae-a496-ade363fcb390″},{“_type”:”model.dotcomrendering.pageElements.TextBlockElement”,”html”:”

Carl Riccadonna, US Chief Economist at BNP Paribas Markets 360, says:

“,”elementId”:”7312565b-49cd-49ef-80c1-34ec4bdbb423″},{“_type”:”model.dotcomrendering.pageElements.BlockquoteBlockElement”,”html”:”

n

The Fed announced a unanimous 75bp hike, coupled with a more hawkish dot plot and Jackson Hole-like press conference in which Chair Powell reiterated the central bank’s commitment to restoring price stability.

n

Powell specifically stated: “Without price stability, the economy does not work for anyone.”

n

He concluded by adamantly assuring that regardless of the exact trajectory of interest rates, the Fed is determined to do “enough to restore price stability.”

n

“,”elementId”:”221f890c-3489-43fa-ad83-0ea87844523b”},{“_type”:”model.dotcomrendering.pageElements.TweetBlockElement”,”html”:”

Apertura mercados europeos:

🇩🇪 DAX 🔻 -1,18%

🇪🇺 EuroStoxx 🔻 -1,78%

🇬🇧 FTSE 🔻 -0,99%

🇫🇷 CAC 🔻 -1,62%

🇮🇹 FTSE MIB 🔻 -1,40%https://t.co/S6BlqjZDk3

— Radio Intereconomía (@rintereconomia) September 22, 2022

n”,”url”:”https://twitter.com/rintereconomia/status/1572844447838224385″,”id”:”1572844447838224385″,”hasMedia”:false,”role”:”inline”,”isThirdPartyTracking”:false,”source”:”Twitter”,”elementId”:”24c3ab57-b70a-49a7-a867-5c4f5e6f814a”},{“_type”:”model.dotcomrendering.pageElements.TextBlockElement”,”html”:”

South Korea’s KOSPI has dropped 1%, while Australia’s S&P/ASX 200 has lost 1.5%.

“,”elementId”:”fa1b266f-6073-4d0e-b414-4536ae0e6ca5″}],”attributes”:{“pinned”:false,”keyEvent”:true,”summary”:false},”blockCreatedOn”:1663831104000,”blockCreatedOnDisplay”:”08.18 BST”,”blockLastUpdated”:1663831789000,”blockLastUpdatedDisplay”:”08.29 BST”,”blockFirstPublished”:1663831789000,”blockFirstPublishedDisplay”:”08.29 BST”,”blockFirstPublishedDisplayNoTimezone”:”08.29″,”contributors”:[],”primaryDateLine”:”Thu 22 Sep 2022 08.29 BST”,”secondaryDateLine”:”First published on Thu 22 Sep 2022 07.51 BST”},{“id”:”632c08508f08146227061de6″,”elements”:[{“_type”:”model.dotcomrendering.pageElements.TextBlockElement”,”html”:”

The Bank of England would hit millions of households more than £3bn in extra mortgage costs if it raises interest rates by 75 basis points (three-quarters of a percent) today.

“,”elementId”:”55dbdcbd-3895-48d5-a194-0e22681f35c4″},{“_type”:”model.dotcomrendering.pageElements.TextBlockElement”,”html”:”

Analysts say the biggest rate hike for more than three decades – which could come at noon – would mean an extra £3.1bn of interest payments for borrowers on standard variable rate and tracker mortgages.

“,”elementId”:”cade7357-1161-41cb-8cbb-b5725d2df3d0″},{“_type”:”model.dotcomrendering.pageElements.TextBlockElement”,”html”:”

Sarah Coles, senior personal finance analyst at Hargreaves Lansdown, said:

“,”elementId”:”155b323a-b160-4b8a-be17-035c52b77c42″},{“_type”:”model.dotcomrendering.pageElements.BlockquoteBlockElement”,”html”:”

n

“For anyone who is already struggling with runaway price rises, the extra cost of the mortgage could be the final straw.”

n

“,”elementId”:”79ea1d61-5e4d-412f-b58d-aec94ebc99e9″},{“_type”:”model.dotcomrendering.pageElements.TextBlockElement”,”html”:”

The investment firm said three-quarters of mortgage holders are on fixed rates, meaning they would not see an immediate impact, but that more than 2 million borrowers are on standard variable rates or trackers.

“,”elementId”:”3762d0a0-6e15-43af-8516-ab02082c4000″},{“_type”:”model.dotcomrendering.pageElements.TextBlockElement”,”html”:”

For the average UK property, with a 75% loan-to-value-mortgage, an increase of 0.75 percentage points would mean a £78 jump in monthly interest payments, according to estimates by TotallyMoney.

“,”elementId”:”a2b9361d-dac0-486d-a7c0-f5c57151b2d0″},{“_type”:”model.dotcomrendering.pageElements.TextBlockElement”,”html”:”

Fixed-rate deals are due to expire for as many as 3.2 million borrowers within the next two years.

“,”elementId”:”19129dfe-f563-4f3e-b96e-2e87d7dade13″},{“_type”:”model.dotcomrendering.pageElements.TextBlockElement”,”html”:”

Here’s the full story:

“,”elementId”:”38da86ee-4e91-437b-b8b1-cfa35df71324″},{“_type”:”model.dotcomrendering.pageElements.RichLinkBlockElement”,”url”:”https://www.theguardian.com/business/2022/sep/21/bank-of-england-may-tackle-inflation-with-major-interest-rate-hike”,”text”:”UK households face £3bn hit if Bank goes ahead with 0.75-points rate rise”,”prefix”:”Related: “,”role”:”thumbnail”,”elementId”:”8b96afbf-4469-4672-becf-a1bdd2b2868e”}],”attributes”:{“pinned”:false,”keyEvent”:true,”summary”:false},”blockCreatedOn”:1663830096000,”blockCreatedOnDisplay”:”08.01 BST”,”blockLastUpdated”:1663830486000,”blockLastUpdatedDisplay”:”08.08 BST”,”blockFirstPublished”:1663830486000,”blockFirstPublishedDisplay”:”08.08 BST”,”blockFirstPublishedDisplayNoTimezone”:”08.08″,”title”:”UK households face £3bn hit if Bank goes ahead with 0.75-points rate rise”,”contributors”:[{“name”:”Richard Partington”,”imageUrl”:”https://i.guim.co.uk/img/uploads/2017/12/27/Richard-Partington.jpg?width=300&quality=85&auto=format&fit=max&s=7a0cd4e01f7289ba75909509b7b8da7c”,”largeImageUrl”:”https://i.guim.co.uk/img/uploads/2017/12/27/Richard_Partington,_R.png?width=300&quality=85&auto=format&fit=max&s=bb38e72cdfabfe7563b4036c49593334″}],”primaryDateLine”:”Thu 22 Sep 2022 08.29 BST”,”secondaryDateLine”:”First published on Thu 22 Sep 2022 07.51 BST”},{“id”:”632c065d8f089a550b8aa3a5″,”elements”:[{“_type”:”model.dotcomrendering.pageElements.TextBlockElement”,”html”:”

Concerns that chancellor Kwasi Kwargeng could put the UK public finances on an “unsustainable path” in his mini-Budget on Friday won’t help the pound either.

“,”elementId”:”533e849b-d0c2-4209-abbb-dc0695f9af19″},{“_type”:”model.dotcomrendering.pageElements.TextBlockElement”,”html”:”

Last night, the respected Institute for Fiscal Studies warned that the government’s planned sweeping tax cuts, at a time of weak economic growth, could leave a £60bn per year hole in the public finances.

“,”elementId”:”ac4e05fa-e3c2-4669-98c2-6be7430eb73e”},{“_type”:”model.dotcomrendering.pageElements.TextBlockElement”,”html”:”

The IFS, in a joint report with Citi, fears that Liz Truss’s government is “choosing to ramp up borrowing just as it becomes more expensive to do so, in a gamble on growth that may not pay off.”

“,”elementId”:”77c6ca8c-4c88-4327-b094-e7a77b7c7f86″},{“_type”:”model.dotcomrendering.pageElements.TweetBlockElement”,”html”:”

Even once the substantial Energy Price Guarantee has expired in October 2024, borrowing could still run at about £100 billion a year in the mid-2020s.

This is more than £60 billion a year higher than the @OBR_uk forecast in March.

[6/13] pic.twitter.com/iZNk5dKQxw

— Institute for Fiscal Studies (@TheIFS) September 21, 2022

n”,”url”:”https://twitter.com/TheIFS/status/1572632518570004480″,”id”:”1572632518570004480″,”hasMedia”:false,”role”:”inline”,”isThirdPartyTracking”:false,”source”:”Twitter”,”elementId”:”5fe4baae-e419-4315-b810-1e2089c9b710″},{“_type”:”model.dotcomrendering.pageElements.TextBlockElement”,”html”:”

My colleague Phillip Inman explains:

“,”elementId”:”2d83bad1-c1d8-44df-8ebd-2fe61fb7d55b”},{“_type”:”model.dotcomrendering.pageElements.TextBlockElement”,”html”:”

Fuelling concerns that the UK’s precarious financial position will spark a run on the pound, the chancellor, Kwasi Kwarteng, is expected to reverse an increase in national insurance payments and cut corporation tax at a cost to the Treasury of £30bn.

“,”elementId”:”67f79e6d-421b-4375-805b-a71b4fa5ff44″},{“_type”:”model.dotcomrendering.pageElements.TextBlockElement”,”html”:”

Kwarteng, who will announce a review of his fiscal rules to allow the government to borrow more, is also expected to give away billions of pounds by cutting stamp duty on house purchases and confirm a multibillion-pound rise in the defence budget to support the war in Ukraine and boost growth

“,”elementId”:”9b602191-5656-4492-84d6-852f3a75f68d”},{“_type”:”model.dotcomrendering.pageElements.TextBlockElement”,”html”:”

These measures will be in addition to a freeze on energy prices for consumers and businesses that could cost more than £150bn over two years.

“,”elementId”:”dc470e33-0765-4e7f-8063-d829bee08041″},{“_type”:”model.dotcomrendering.pageElements.TextBlockElement”,”html”:”

The IFS report said:

“,”elementId”:”5c9a3c41-795d-4375-ae3a-9a8091453d9d”},{“_type”:”model.dotcomrendering.pageElements.BlockquoteBlockElement”,”html”:”

n

“Recent rapid increases in the cost of debt interest highlight the risks of substantially and permanently increasing borrowing and putting debt on an ever-increasing path.”

n

“There is no miracle cure, and setting plans underpinned by the idea that headline tax cuts will deliver a sustained boost to growth is a gamble, at best.”

n

“,”elementId”:”6e51bb10-86ce-41af-b838-4fb792c7e5d7″},{“_type”:”model.dotcomrendering.pageElements.TweetBlockElement”,”html”:”

Persistent current budget deficits and rising debt as a share of national income would mean that the two main fiscal targets legislated only in January would be missed.

Even once the Energy Price Guarantee has expired, debt would be left on an ever-increasing path.

[9/13] pic.twitter.com/UuSf6BpXMU— Institute for Fiscal Studies (@TheIFS) September 21, 2022

n”,”url”:”https://twitter.com/TheIFS/status/1572632526862024704″,”id”:”1572632526862024704″,”hasMedia”:false,”role”:”inline”,”isThirdPartyTracking”:false,”source”:”Twitter”,”elementId”:”f24ccb0a-3dfc-48cd-9cc4-2cf0319831c6″}],”attributes”:{“pinned”:false,”keyEvent”:true,”summary”:false},”blockCreatedOn”:1663829597000,”blockCreatedOnDisplay”:”07.53 BST”,”blockLastUpdated”:1663830058000,”blockLastUpdatedDisplay”:”08.00 BST”,”blockFirstPublished”:1663830058000,”blockFirstPublishedDisplay”:”08.00 BST”,”blockFirstPublishedDisplayNoTimezone”:”08.00″,”title”:”Mini-Budget risks setting UK on ‘unsustainable path’”,”contributors”:[],”primaryDateLine”:”Thu 22 Sep 2022 08.29 BST”,”secondaryDateLine”:”First published on Thu 22 Sep 2022 07.51 BST”},{“id”:”632bf52d8f08f4c4bf5d7cad”,”elements”:[{“_type”:”model.dotcomrendering.pageElements.TextBlockElement”,”html”:”

Good morning, and welcome to our rolling coverage of business, the world economy and the financial markets.

“,”elementId”:”467058f4-9173-47cc-b3ff-1f09bf585b31″},{“_type”:”model.dotcomrendering.pageElements.TextBlockElement”,”html”:”

A plethora of problems have sent sterling sliding to a new 37-year low against the US dollar, ahead of a crunch Bank of England interest rate decision.

“,”elementId”:”f832716f-60e0-4f34-86c6-c8859bba59e7″},{“_type”:”model.dotcomrendering.pageElements.TextBlockElement”,”html”:”

The pound has dropped to $1.123 this morning, the lowest since 1985, extending its recent slump – it’s now down almost 17% so far this year.

“,”elementId”:”72daef34-93ef-4d5d-bcdb-b4beb9ca94b9″},{“_type”:”model.dotcomrendering.pageElements.ImageBlockElement”,”media”:{“allImages”:[{“index”:0,”fields”:{“height”:”383″,”width”:”744″},”mediaType”:”Image”,”mimeType”:”image/jpeg”,”url”:”https://media.guim.co.uk/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/744.jpg”},{“index”:1,”fields”:{“isMaster”:”true”,”height”:”383″,”width”:”744″},”mediaType”:”Image”,”mimeType”:”image/jpeg”,”url”:”https://media.guim.co.uk/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg”},{“index”:2,”fields”:{“height”:”257″,”width”:”500″},”mediaType”:”Image”,”mimeType”:”image/jpeg”,”url”:”https://media.guim.co.uk/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/500.jpg”},{“index”:3,”fields”:{“height”:”72″,”width”:”140″},”mediaType”:”Image”,”mimeType”:”image/jpeg”,”url”:”https://media.guim.co.uk/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/140.jpg”}]},”data”:{“alt”:”The pound vs the US dollar over the last 20 years”,”caption”:”The pound vs the US dollar over the last 20 years”,”credit”:”Photograph: Refinitiv”},”displayCredit”:true,”role”:”inline”,”imageSources”:[{“weighting”:”inline”,”srcSet”:[{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=620&quality=85&auto=format&fit=max&s=cdd3cb40a40cdefed724ed3a83391c2d”,”width”:620},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=620&quality=45&auto=format&fit=max&dpr=2&s=15f59c4957549a3b79aa4532cc36f5b9″,”width”:1240},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=605&quality=85&auto=format&fit=max&s=d1e888343bfb5baa2ef3311bfad29d5c”,”width”:605},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=605&quality=45&auto=format&fit=max&dpr=2&s=9456c5439f23b632c5bbf251c4af8658″,”width”:1210},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=445&quality=85&auto=format&fit=max&s=224cb32f0c3eebcca1421fb036128a69″,”width”:445},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=445&quality=45&auto=format&fit=max&dpr=2&s=6688539c0ed2b3e829883af59ca98e8a”,”width”:890}]},{“weighting”:”thumbnail”,”srcSet”:[{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=140&quality=85&auto=format&fit=max&s=a48fbe21c214a625338ffcf15316bbb1″,”width”:140},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=140&quality=45&auto=format&fit=max&dpr=2&s=fd50705ebfb1f78fa4fb6c2b046cba3f”,”width”:280},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=120&quality=85&auto=format&fit=max&s=8658ff3ca5e8ec4bd75432919fc6d9a2″,”width”:120},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=120&quality=45&auto=format&fit=max&dpr=2&s=2791dd941b369ff1c87f721358fd94f3″,”width”:240}]},{“weighting”:”supporting”,”srcSet”:[{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=380&quality=85&auto=format&fit=max&s=5ccc8eaa702c67a21f573dcfbed6859e”,”width”:380},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=380&quality=45&auto=format&fit=max&dpr=2&s=a63e3986a3dff01e39e76755d157f5b1″,”width”:760},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=300&quality=85&auto=format&fit=max&s=7f1eb9290ad3cb406eef544fc0bf13a1″,”width”:300},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=300&quality=45&auto=format&fit=max&dpr=2&s=d14112c7f3701cfc549f9e77ce0af38e”,”width”:600},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=620&quality=85&auto=format&fit=max&s=cdd3cb40a40cdefed724ed3a83391c2d”,”width”:620},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=620&quality=45&auto=format&fit=max&dpr=2&s=15f59c4957549a3b79aa4532cc36f5b9″,”width”:1240},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=605&quality=85&auto=format&fit=max&s=d1e888343bfb5baa2ef3311bfad29d5c”,”width”:605},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=605&quality=45&auto=format&fit=max&dpr=2&s=9456c5439f23b632c5bbf251c4af8658″,”width”:1210},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=445&quality=85&auto=format&fit=max&s=224cb32f0c3eebcca1421fb036128a69″,”width”:445},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=445&quality=45&auto=format&fit=max&dpr=2&s=6688539c0ed2b3e829883af59ca98e8a”,”width”:890}]},{“weighting”:”showcase”,”srcSet”:[{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=860&quality=85&auto=format&fit=max&s=04ef87f38df40d1b5d92cb330b4d7595″,”width”:860},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=860&quality=45&auto=format&fit=max&dpr=2&s=072eee588bcd1b3024738ce1e129103d”,”width”:1720},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=780&quality=85&auto=format&fit=max&s=5acf7006302dc01e67520386ed9e6785″,”width”:780},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=780&quality=45&auto=format&fit=max&dpr=2&s=5cc91e89b16025602961fd9315140f07″,”width”:1560},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=620&quality=85&auto=format&fit=max&s=cdd3cb40a40cdefed724ed3a83391c2d”,”width”:620},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=620&quality=45&auto=format&fit=max&dpr=2&s=15f59c4957549a3b79aa4532cc36f5b9″,”width”:1240},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=605&quality=85&auto=format&fit=max&s=d1e888343bfb5baa2ef3311bfad29d5c”,”width”:605},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=605&quality=45&auto=format&fit=max&dpr=2&s=9456c5439f23b632c5bbf251c4af8658″,”width”:1210},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=445&quality=85&auto=format&fit=max&s=224cb32f0c3eebcca1421fb036128a69″,”width”:445},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=445&quality=45&auto=format&fit=max&dpr=2&s=6688539c0ed2b3e829883af59ca98e8a”,”width”:890}]},{“weighting”:”halfwidth”,”srcSet”:[{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=620&quality=85&auto=format&fit=max&s=cdd3cb40a40cdefed724ed3a83391c2d”,”width”:620},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=620&quality=45&auto=format&fit=max&dpr=2&s=15f59c4957549a3b79aa4532cc36f5b9″,”width”:1240},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=605&quality=85&auto=format&fit=max&s=d1e888343bfb5baa2ef3311bfad29d5c”,”width”:605},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=605&quality=45&auto=format&fit=max&dpr=2&s=9456c5439f23b632c5bbf251c4af8658″,”width”:1210},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=445&quality=85&auto=format&fit=max&s=224cb32f0c3eebcca1421fb036128a69″,”width”:445},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=445&quality=45&auto=format&fit=max&dpr=2&s=6688539c0ed2b3e829883af59ca98e8a”,”width”:890}]},{“weighting”:”immersive”,”srcSet”:[{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=1900&quality=85&auto=format&fit=max&s=2e897a01d070d889edc1c91475ed82c3″,”width”:1900},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=1900&quality=45&auto=format&fit=max&dpr=2&s=cfc1b78375651dca2db29cb427011262″,”width”:3800},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=1300&quality=85&auto=format&fit=max&s=48b5aa00d57ff9653ca3fce933238e33″,”width”:1300},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=1300&quality=45&auto=format&fit=max&dpr=2&s=e64505464bfb30a7e3ae6eafc0ab59d5″,”width”:2600},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=1140&quality=85&auto=format&fit=max&s=d3352fdfef668e5ca027763c6e63205e”,”width”:1140},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=1140&quality=45&auto=format&fit=max&dpr=2&s=f99dd0d70ad62e8d6c4f1c2eef4b1cdb”,”width”:2280},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=980&quality=85&auto=format&fit=max&s=99652bb168dc13daa62ae2817db7ed34″,”width”:980},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=980&quality=45&auto=format&fit=max&dpr=2&s=55682af9e29aa24a193c87be1cb5af4e”,”width”:1960},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=740&quality=85&auto=format&fit=max&s=363d0d79901096aba9b8af0501d70e36″,”width”:740},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=740&quality=45&auto=format&fit=max&dpr=2&s=d5fe400c8d6cc02481f58bdefddb3fad”,”width”:1480},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=660&quality=85&auto=format&fit=max&s=5043f7a910fb559e58e3d6fdf78a9277″,”width”:660},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=660&quality=45&auto=format&fit=max&dpr=2&s=9fd456a59f609e05ace9ef9461cf7ca1″,”width”:1320},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=480&quality=85&auto=format&fit=max&s=00cc7ade6f0f07f745c60d666e9698a3″,”width”:480},{“src”:”https://i.guim.co.uk/img/media/d19e0cc813e40cd92b126699b0991e4e6479ac59/0_0_744_383/master/744.jpg?width=480&quality=45&auto=format&fit=max&dpr=2&s=c96c4d03bd88a408c2782c475391b455″,”width”:960}]}],”elementId”:”35a28257-38c5-4863-8c13-4890939982c8″},{“_type”:”model.dotcomrendering.pageElements.TextBlockElement”,”html”:”

It lost more ground against the rampant dollar after America’s Federal Reserve delivered its third hefty interest rate rise in a row last night, lifting rates by another 75 basis points (three-quarters of a percent).

“,”elementId”:”2c2f7fd1-1b84-4626-b20b-f93b449b6e29″},{“_type”:”model.dotcomrendering.pageElements.TextBlockElement”,”html”:”

Anxiety about Vladimir Putin’s threat of nuclear retaliation against the West are hitting the markets.

“,”elementId”:”450aa064-d9f2-4a1e-b2ae-cec6026ca051″},{“_type”:”model.dotcomrendering.pageElements.TextBlockElement”,”html”:”

UK assets are also being weighed down by concerns over Liz Truss’s push for unfunded tax cuts and spending pledges such as yesterday’s energy price cap for non-domestic users, which will add to borrowing.

“,”elementId”:”ecd9028c-4a4e-4d42-be67-a005266d9ad2″},{“_type”:”model.dotcomrendering.pageElements.TextBlockElement”,”html”:”

Yesterday’s August public finances, showing the UK borrowed almost twice as much as expected, has added to the pressure.

“,”elementId”:”c7a9cd40-cd22-4ea7-861d-bbd0a628b5ff”},{“_type”:”model.dotcomrendering.pageElements.TweetBlockElement”,”html”:”

Cost to taxpayer of Truss’s £100bn energy package has escaped scrutiny – but could that be harmful in the long run? https://t.co/1QFuvhivhp

— Jessica Elgot (@jessicaelgot) September 21, 2022

n”,”url”:”https://twitter.com/jessicaelgot/status/1572656470394798080″,”id”:”1572656470394798080″,”hasMedia”:false,”role”:”inline”,”isThirdPartyTracking”:false,”source”:”Twitter”,”elementId”:”534feed0-f7fc-497a-ba42-55f7e73a9b94″},{“_type”:”model.dotcomrendering.pageElements.TextBlockElement”,”html”:”

Fed chair Jerome Powell rattled investors last night by insisting, again, that his central bank would keep tightening rates to push down inflation, and wouldn’t rule out a recession.

“,”elementId”:”29d0e784-0a1b-49af-85a8-63eed74506c7″},{“_type”:”model.dotcomrendering.pageElements.TextBlockElement”,”html”:”

Powell warned:

“,”elementId”:”4ff17c4d-2744-4f11-9aad-26930b2f28d7″},{“_type”:”model.dotcomrendering.pageElements.BlockquoteBlockElement”,”html”:”

n

We have always understood that restoring price stability while achieving a relatively modest increase in unemployment and a soft landing would be very challenging.

n

And we don’t know. No one knows whether this process will lead to a recession or if so, how significant that recession would be.”

n

“,”elementId”:”a2c9c367-d525-4657-a8c3-26b04fd3d325″},{“_type”:”model.dotcomrendering.pageElements.RichLinkBlockElement”,”url”:”https://www.theguardian.com/business/2022/sep/21/fed-raises-interest-rates-third-increase-in-row”,”text”:”Fed raises interest rate by 0.75 percentage points as US seeks to rein in inflation”,”prefix”:”Related: “,”role”:”thumbnail”,”elementId”:”dfad2a33-c6e5-45c2-9ae3-7780dc5b5462″},{“_type”:”model.dotcomrendering.pageElements.TextBlockElement”,”html”:”

This drove investors into the dollar, which has hit two-decade highs against the euro and the yen this morning too.

“,”elementId”:”452ba526-e17a-481b-bde8-ba12ff4c2a1d”},{“_type”:”model.dotcomrendering.pageElements.TweetBlockElement”,”html”:”

*Sterling Falls To 37-Year Low Of $1.1225

*Euro Falls To Two-Decade Low Of $0.9807

— *seven (@sevenloI) September 22, 2022

n”,”url”:”https://twitter.com/sevenloI/status/1572754955965972481″,”id”:”1572754955965972481″,”hasMedia”:false,”role”:”inline”,”isThirdPartyTracking”:false,”source”:”Twitter”,”elementId”:”0335dda1-9b38-4fdc-9bcd-58fb4a3df77a”},{“_type”:”model.dotcomrendering.pageElements.TextBlockElement”,”html”:”

But will the Bank of England deliver a hawkish rate hike too?

“,”elementId”:”faea236d-e483-402d-bb00-a1a943c33568″},{“_type”:”model.dotcomrendering.pageElements.TextBlockElement”,”html”:”

The money markets say there’s roughly an 90% chance that the BoE will raise Bank Rate by 75 basis points at noon today, to 2.5%, as it tried to tame inflation.

“,”elementId”:”372fbc58-19fb-4bf2-b7ba-2bd56a068f52″},{“_type”:”model.dotcomrendering.pageElements.TextBlockElement”,”html”:”

That would be its biggest raise increase since 1989, and take borrowing costs to their highest levels since late 2008.

“,”elementId”:”70628b43-b798-4ca7-b4a4-05ccca855ac7″},{“_type”:”model.dotcomrendering.pageElements.TextBlockElement”,”html”:”

But some economists think the Bank might ‘only’ raise rates by another half a percent, repeating last month’s move (which was the biggest rise since 1995).

“,”elementId”:”6d32e675-50ae-404a-ba76-27e96120f704″},{“_type”:”model.dotcomrendering.pageElements.TextBlockElement”,”html”:”

Policymakers may want to see the impact of the government’s energy bill freeze, which is likely to prevent inflation soaring as much as feared in the short term – while also adding to price pressure further ahead.

“,”elementId”:”19728fd3-d3a9-4505-8e0d-61408c815f96″},{“_type”:”model.dotcomrendering.pageElements.TextBlockElement”,”html”:”

The Bank could also announce the start of ‘quantitative tightening’, cutting back its holding of UK government debt bought during the financial crisis, and the pandemic.

“,”elementId”:”3b1cb268-5322-4351-bca5-3f235ae5089b”},{“_type”:”model.dotcomrendering.pageElements.TextBlockElement”,”html”:”

Kallum Pickering, senior economist at Berenberg, suggests this might lead the Bank towards a half-point rate rise:

“,”elementId”:”0d9de0b9-8356-46c2-9090-1c6323b98976″},{“_type”:”model.dotcomrendering.pageElements.BlockquoteBlockElement”,”html”:”

n

While 75bp is far from inconceivable, 50bp remains more likely, in our view. Remember, in addition to raising rates, the BoE looks set to announce the start of active selling gilts as part of its quantitative tightening policy.

n

As financial conditions are already tightening as benchmark rates edge ever higher, we believe the BoE will wait to see the impact of active QT before deciding on whether to steepen the trajectory of rate hikes.

n

“,”elementId”:”105e96f2-70bc-4c0a-a91d-c1a89fcf2979″},{“_type”:”model.dotcomrendering.pageElements.TextBlockElement”,”html”:”

A smaller hike could further weaken the pound. And either way, higher borrowing costs will add to the burden on consumers amid the cost of living squeeze.

“,”elementId”:”ca650e32-5429-4805-9deb-07ac68a51279″},{“_type”:”model.dotcomrendering.pageElements.TextBlockElement”,”html”:”

It’s a busy day for monetary policy. Switzerland and Norway’s central banks are both setting interest rate today – with the Swiss National Bank expected to raise rates by 75bp, out of negative territory.

“,”elementId”:”9c44f217-2eb2-4465-83c5-8499e070e62a”},{“_type”:”model.dotcomrendering.pageElements.SubheadingBlockElement”,”html”:”

The agenda

“,”elementId”:”ec3ad1ff-f074-4bb8-b772-19c0ded3a10f”},{“_type”:”model.dotcomrendering.pageElements.TextBlockElement”,”html”:”

- n

-

8.30am BST: Swiss National Bank interest rate decision

-

9am BST: Norway’s Norges Bank interest rate decision

-

9.30am BST: ONS’s economic activity and business insights data on UK economy

-

12pm BST: Bank of England interest rate decision

-

1.30pm BST: US weekly jobless claims

-

2.15pm BST: Treasury Committee to scrutinise yesterday’s energy price cap announcement and look ahead to mini-budget

-

3pm BST: Eurozone consumer confidence flash estimate for September

n

n

n

n

n

n

n

“,”elementId”:”6ca0656c-7c7e-4d1a-8af0-999f8f1e5e7e”}],”attributes”:{“pinned”:true,”keyEvent”:true,”summary”:false},”blockCreatedOn”:1663829488000,”blockCreatedOnDisplay”:”07.51 BST”,”blockLastUpdated”:1663830726000,”blockLastUpdatedDisplay”:”08.12 BST”,”blockFirstPublished”:1663829488000,”blockFirstPublishedDisplay”:”07.51 BST”,”blockFirstPublishedDisplayNoTimezone”:”07.51″,”title”:”Introduction: Pound at 37-year low against dollar as Bank of England decision looms”,”contributors”:[],”primaryDateLine”:”Thu 22 Sep 2022 08.29 BST”,”secondaryDateLine”:”First published on Thu 22 Sep 2022 07.51 BST”}],”filterKeyEvents”:false,”id”:”key-events-carousel-mobile”}”>

Filters BETA

Stock markets have opened sharply lower across Europe, following losses in Asia, after last night’s hawkish interest rate hike by the US Federal Reserve rattled Wall Street.

In London, the FTSE 100 index has dropped 1%, or 71 points, to a three-week low of 7168 points.

Almost every share on the blue-chip index is lower, with investment companies, property firms and hotel groups among the fallers.

Germany’s DAX and France’s CAC have both tumbled around 1.7%.

Fed chair Powell’s warning that there wasn’t a painless way to bring down inflation has heightened anxiety that the US will see weaker growth and higher unemployment, hurting the global economy too.

Carl Riccadonna, US Chief Economist at BNP Paribas Markets 360, says:

The Fed announced a unanimous 75bp hike, coupled with a more hawkish dot plot and Jackson Hole-like press conference in which Chair Powell reiterated the central bank’s commitment to restoring price stability.

Powell specifically stated: “Without price stability, the economy does not work for anyone.”

He concluded by adamantly assuring that regardless of the exact trajectory of interest rates, the Fed is determined to do “enough to restore price stability.”

Apertura mercados europeos:

🇩🇪 DAX 🔻 -1,18%

🇪🇺 EuroStoxx 🔻 -1,78%

🇬🇧 FTSE 🔻 -0,99%

🇫🇷 CAC 🔻 -1,62%

🇮🇹 FTSE MIB 🔻 -1,40%https://t.co/S6BlqjZDk3

— Radio Intereconomía (@rintereconomia) September 22, 2022

n”,”url”:”https://twitter.com/rintereconomia/status/1572844447838224385″,”id”:”1572844447838224385″,”hasMedia”:false,”role”:”inline”,”isThirdPartyTracking”:false,”source”:”Twitter”,”elementId”:”cef28a42-fd7c-4ac4-afbe-f5c271e40830″}}”>

Apertura mercados europeos:

🇩🇪 DAX 🔻 -1,18%

🇪🇺 EuroStoxx 🔻 -1,78%

🇬🇧 FTSE 🔻 -0,99%

🇫🇷 CAC 🔻 -1,62%

🇮🇹 FTSE MIB 🔻 -1,40%https://t.co/S6BlqjZDk3

— Radio Intereconomía (@rintereconomia) September 22, 2022

South Korea’s KOSPI has dropped 1%, while Australia’s S&P/ASX 200 has lost 1.5%.

Fears of a European recession are hitting the euro again, as it weakens further against the Swiss franc:

OUCH! #Euro hit fresh low against Swiss Franc below 0.95. pic.twitter.com/pqrJQZuVEk

— Holger Zschaepitz (@Schuldensuehner) September 22, 2022

n”,”url”:”https://twitter.com/Schuldensuehner/status/1572844991789076480″,”id”:”1572844991789076480″,”hasMedia”:false,”role”:”inline”,”isThirdPartyTracking”:false,”source”:”Twitter”,”elementId”:”8f6692a3-5ad2-4a67-92c0-e3cd6b91b88e”}}”/>

The Bank of Japan has defied the push towards higher interest rates, though.

The BoJ kept rates at ultra-low levels today, and pledged to hold them there to support economic growth – hours after the Federal Reserve delivered its third straight 75bpp hike and signalled more were coming.

This rare dovishness sent the yen reeling to a fresh 24-year low – adding to the challenge of supporting Japan’s fragile economy without accelerating the decline in the yen which makes imports pricier.

BOJ announced it will hold ground on ultra-low rates, and stay with the yield curve control policy – Yen weakened past 145 level, high at 145.32 against the dollar. pic.twitter.com/R65ZoiwrsP

— D (@0122200284mo) September 22, 2022

n”,”url”:”https://twitter.com/0122200284mo/status/1572801913007271936″,”id”:”1572801913007271936″,”hasMedia”:false,”role”:”inline”,”isThirdPartyTracking”:false,”source”:”Twitter”,”elementId”:”d841acf4-d362-4715-8807-e6e822b22544″}}”>

BOJ announced it will hold ground on ultra-low rates, and stay with the yield curve control policy – Yen weakened past 145 level, high at 145.32 against the dollar. pic.twitter.com/R65ZoiwrsP

— D (@0122200284mo) September 22, 2022

Japan’s core consumer inflation rate rose to an eight-year high in August, but at 2.8% its still much lower than the US, UK or eurozone.

BOJ keeps ultra-low rates, remains global outlier despite weak #yen https://t.co/r2HCZimEzK

As widely expected, #BOJ kept unchanged its -0.1% target for short-term #interestrates, & 0% for the 10-year #JGB yield by a unanimous vote#JPY dropped to a 24-year low of 145.405 #Fed

— Divya Chowdhury (@divyachowdhury) September 22, 2022

n”,”url”:”https://twitter.com/divyachowdhury/status/1572795132369580032″,”id”:”1572795132369580032″,”hasMedia”:false,”role”:”inline”,”isThirdPartyTracking”:false,”source”:”Twitter”,”elementId”:”11551dad-b8fe-4c62-8b8d-bfc8f83b273c”}}”/>

UK households face £3bn hit if Bank goes ahead with 0.75-points rate rise

Richard Partington

The Bank of England would hit millions of households more than £3bn in extra mortgage costs if it raises interest rates by 75 basis points (three-quarters of a percent) today.

Analysts say the biggest rate hike for more than three decades – which could come at noon – would mean an extra £3.1bn of interest payments for borrowers on standard variable rate and tracker mortgages.

Sarah Coles, senior personal finance analyst at Hargreaves Lansdown, said:

“For anyone who is already struggling with runaway price rises, the extra cost of the mortgage could be the final straw.”

The investment firm said three-quarters of mortgage holders are on fixed rates, meaning they would not see an immediate impact, but that more than 2 million borrowers are on standard variable rates or trackers.

For the average UK property, with a 75% loan-to-value-mortgage, an increase of 0.75 percentage points would mean a £78 jump in monthly interest payments, according to estimates by TotallyMoney.

Fixed-rate deals are due to expire for as many as 3.2 million borrowers within the next two years.

Here’s the full story:

Mini-Budget risks setting UK on ‘unsustainable path’

Concerns that chancellor Kwasi Kwargeng could put the UK public finances on an “unsustainable path” in his mini-Budget on Friday won’t help the pound either.

Last night, the respected Institute for Fiscal Studies warned that the government’s planned sweeping tax cuts, at a time of weak economic growth, could leave a £60bn per year hole in the public finances.

The IFS, in a joint report with Citi, fears that Liz Truss’s government is “choosing to ramp up borrowing just as it becomes more expensive to do so, in a gamble on growth that may not pay off.”

Even once the substantial Energy Price Guarantee has expired in October 2024, borrowing could still run at about £100 billion a year in the mid-2020s.

This is more than £60 billion a year higher than the @OBR_uk forecast in March.

[6/13] pic.twitter.com/iZNk5dKQxw

— Institute for Fiscal Studies (@TheIFS) September 21, 2022

n”,”url”:”https://twitter.com/TheIFS/status/1572632518570004480″,”id”:”1572632518570004480″,”hasMedia”:false,”role”:”inline”,”isThirdPartyTracking”:false,”source”:”Twitter”,”elementId”:”fcd8e70f-c315-41d0-b9a8-8db8aff892c6″}}”>

Even once the substantial Energy Price Guarantee has expired in October 2024, borrowing could still run at about £100 billion a year in the mid-2020s.

This is more than £60 billion a year higher than the @OBR_uk forecast in March.

[6/13] pic.twitter.com/iZNk5dKQxw

— Institute for Fiscal Studies (@TheIFS) September 21, 2022

My colleague Phillip Inman explains:

Fuelling concerns that the UK’s precarious financial position will spark a run on the pound, the chancellor, Kwasi Kwarteng, is expected to reverse an increase in national insurance payments and cut corporation tax at a cost to the Treasury of £30bn.

Kwarteng, who will announce a review of his fiscal rules to allow the government to borrow more, is also expected to give away billions of pounds by cutting stamp duty on house purchases and confirm a multibillion-pound rise in the defence budget to support the war in Ukraine and boost growth

These measures will be in addition to a freeze on energy prices for consumers and businesses that could cost more than £150bn over two years.

The IFS report said:

“Recent rapid increases in the cost of debt interest highlight the risks of substantially and permanently increasing borrowing and putting debt on an ever-increasing path.”

“There is no miracle cure, and setting plans underpinned by the idea that headline tax cuts will deliver a sustained boost to growth is a gamble, at best.”

Persistent current budget deficits and rising debt as a share of national income would mean that the two main fiscal targets legislated only in January would be missed.

Even once the Energy Price Guarantee has expired, debt would be left on an ever-increasing path.

[9/13] pic.twitter.com/UuSf6BpXMU

— Institute for Fiscal Studies (@TheIFS) September 21, 2022

n”,”url”:”https://twitter.com/TheIFS/status/1572632526862024704″,”id”:”1572632526862024704″,”hasMedia”:false,”role”:”inline”,”isThirdPartyTracking”:false,”source”:”Twitter”,”elementId”:”cd6a910e-0662-4a97-a855-2f264148dc2f”}}”>

Persistent current budget deficits and rising debt as a share of national income would mean that the two main fiscal targets legislated only in January would be missed.

Even once the Energy Price Guarantee has expired, debt would be left on an ever-increasing path.

[9/13] pic.twitter.com/UuSf6BpXMU— Institute for Fiscal Studies (@TheIFS) September 21, 2022

Introduction: Pound at 37-year low against dollar as Bank of England decision looms

Good morning, and welcome to our rolling coverage of business, the world economy and the financial markets.

A plethora of problems have sent sterling sliding to a new 37-year low against the US dollar, ahead of a crunch Bank of England interest rate decision.

The pound has dropped to $1.123 this morning, the lowest since 1985, extending its recent slump – it’s now down almost 17% so far this year.

It lost more ground against the rampant dollar after America’s Federal Reserve delivered its third hefty interest rate rise in a row last night, lifting rates by another 75 basis points (three-quarters of a percent).

Anxiety about Vladimir Putin’s threat of nuclear retaliation against the West are hitting the markets.