The Government and the National Road Transport Committee (CNTC) have reached an agreement to lift the transport strike. Direct subsidy of 20 cents/liter of fuel and more than 1,000 million in aid that the National Platform for the Defense of Transport, the first conveners of the strike, consider insufficient and assure that the strikes will continue. Although the aid is more extensive, the price of fuel has focused the debate.

the deal. Direct subsidy of 20 cents per liter of fuel, whether diesel, gasoline or gas. And another 20 cents/liter of aid for AdBlue, a chemical necessary to reduce polluting emissions from diesel engines. Of these, 15 cents/liter will be borne by the State and the remaining five cents will be assumed by the service stations, which have not been called in the negotiations.

In addition, the agreement between the CNTC and the Government includes other measures, beyond the 450 million euros that it is estimated that the State will assume to reduce the price of fuel. Another 450 million euros of direct aid will also be allocated for the transport of goods and people, ranging from 1,250 euros for each truck to 300 euros that will be received by light vehicles, such as taxis, VTC or ambulances (also included in the of the fuel). Companies may receive a maximum of 400,000 euros in aid. In addition, the conditions of ICO credits are improved and the abandonment of the activity is made easier for self-employed truckers.

taxes. The elephant in the room in this strike is being taxes. Right now, we pay less for them than two years ago, and yet the state collects more. This is due to their own configuration. The money collected with VAT rises in the same proportion as the price of fuel. The Special Tax on Hydrocarbons, on the other hand, has a fixed amount, so its weight in the final price is lower.

In fact, the rise in the last month has been such that the week of February 21 in Spain, 47% taxes were paid in the case of gasoline and 43% for diesel. In its latest report, the European Commission encrypts this data at 43% for gasoline and 38% for diesel. Two years ago, just before the Spanish lockdown, we paid 56% tax on gasoline and 51% on diesel.

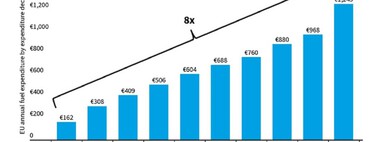

More collection. What is the real impact on the state accounts? It is difficult to find an exact figure, but we can make a series of calculations that give us a rough idea. At the current price of gasoline, the European Commission figures that the State collects 0.787 euros for each liter of gasoline and 0.691 euros for each liter of diesel. Two years ago (in January 2020) this figure was 0.701 euros per liter of gasoline and 0.591 euros per liter of diesel. In other words, for every liter of gasoline the State collects eight cents more than it did a little over two years ago and ten cents more for each liter of diesel. We have taken the January data as a reference for a reason that we see below.

The latest data on the consumption of diesel and gasoline for transport in Spain is for the month of January 2022. According to the Corporation for Strategic Reserves of Petroleum Products (Cores), only that month 395,055 tons of gasoline were consumed, which represents about 213,329,700 liters of gasoline, taking as a reference that each liter weighs 0.540 kg. So, for each liter of fuel, the State collected 0.740 euros/liter in gasoline, which makes a total collection in that month of 157,863,978 euros.

Carrying out the same calculations for diesel (with a weight of 0.850 kg per litre), in January 2022, 1,421,479,650 liters of diesel were consumed and then 0.594 euros/litre were collected, which makes a total estimate of 844,358,912 euros. . If we add both amounts, the State collected 1,002,222,890 euros in fuel taxes only in the past month of January.

looking to the past. If we look back and look at the consumption and prices for the month of January 2020, we find that the price of fuel was 1,318 euros/liter for gasoline and 1,236 euros/liter for diesel.

With the weight of taxes at that time, Spain collected 157,614,971 euros in gasoline and 928,184,429 euros in diesel in the same month, for a total of 1,085,799,400 euros. A very similar figure but derived from a higher consumption of diesel in January 2020, 1,562,600,050 liters of that year for the 1,421,479,650 liters of diesel in January 2022.

Making a complete photograph, taking as a reference the consumption of January 2022, the last for which we have data, the State would have collected this March a total of 167,890,474 euros in gasoline and 982,242,438 euros in diesel. A sum of 1,150,132,912 euros. Or, what is the same, almost 148 million euros more than two months ago. A fact solely motivated by the rise in fuel.

what i win. To all of the above, one more thing must be added. Consumption is total, not exclusively from the transport sector. A drop of 15 cents/liter in the price of fuel assumed by the State is calculated at 450 million euros between the months of April and June, which, at first, will last the subsidy. It is practically the same extra money that the State has been earning monthly since January with the rise in fuel prices.

In addition, it must be taken into account that if the price of fuel rises again, the transport sector will proportionally contribute the same as it does now, but the State will continue to win, since the ordinary citizen will again leave more money in taxes although, as we have said, these represent a lower percentage weight in the final price.

Photo | Anthony

George is Digismak’s reported cum editor with 13 years of experience in Journalism