Reaching 30 in worse shape than friends or work colleagues can make the bite harder to swallow. The mid-life crisis is likely to worsen with less hair on the head or more kilos on the waist … And if not tell the Ibex 35, which will blow its 30 candles next Friday, January 14 more or less in this point.

The benchmark index of the Spanish stock market managed to close 2021 in positive, with a gain of 7.93% in the year to 8,713.8 points. However, in a year in which the main international trading floors posted significant increases and some even renewed their all-time highs, the Spaniard claimed the title of ‘laggard’. Thus, it lagged behind other European indices such as the Eurostoxx 50, which ended the year with a 21% rebound; the German Dax 30, which advanced 16%; the Italian Mib (+ 23%) or the Cac 40, the one that performed the best when it rose by 29.2%.

Even including dividends in the equation (taking the Ibex Total Return as a reference), an «important point» to compare with pairs such as the Dax, in the opinion of analyst Javier Molina, spokesperson for eToro in Spain, the Spanish selective is still at « 9% of the maximums, against the zone of maximums of the North American indices or the same Dax ».

Heavyweights such as BBVA, Santander or Iberdrola “could boost the Ibex 35” during 2022

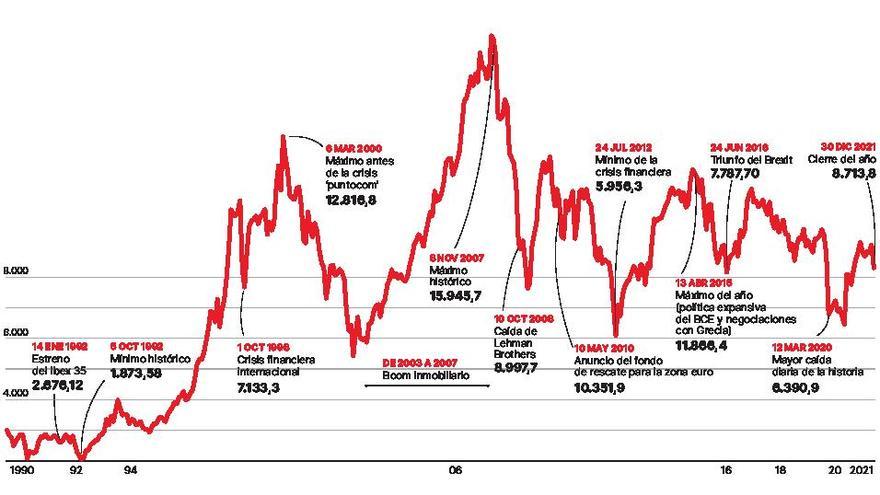

The progress of 2021 has also been insufficient to return to pre-pandemic levels: it was the European stock market that suffered the most from the covid and it was left 15.45% in 2020. It has managed to recover since the hit of March 12, 2020, when the panic of the then unknown virus caused a record daily collapse of 14.06%, although it remains far from the around 10,000 in which it was moving at the beginning of 2020. And despite having multiplied by more than three times its value Since it was released in 1992, it has not smelled the 15,945 points at which it closed on November 8, 2007. “It has dropped more than 40% from its all-time highs,” corroborates Diego Morín, an analyst at IG.

Ups and downs

As a good millennial, in its 30 years of life the Ibex 35 has gone through hopeful periods of taking over the world that have been truncated by more convulsive moments. From the technological miracle it went to the bursting of the dotcom bubble in the early 2000s. From the exuberance of the real estate business to its subsequent resounding decline, accompanied by a global financial crisis that began in 2007, which in Morín’s opinion the index has not yet been able to recover.

‘Men in black’, bailouts with conditions, bank reconversion, unemployment, inflation … These are events that have marked these three decades, although due to its “exceptionality” the pandemic stands out above all of them, according to Victoria Torre, director of digital offer of Singular Bank. “There have been numerous economic crises, but Covid 19 has been a health crisis that has led to a financial crisis not seen since World War II,” he says, adding that “the final impact remains to be seen.”

Experts explain that the Ibex 35 is at the bottom of Europe for several reasons, including the lower diversification of sectors in the composition of the selective or the low weight of technology companies and related to the industry. In turn, sources from Bolsas y Mercados de España (BME) indicate to ‘assets’ that another factor is that the composition of the selective is calculated without taking into account the dividends paid by listed companies, «and the Spanish market has historically shown a high profitability for this concept “.

The “relevant exposure to the Latin American region, which this year has not performed well, has also had an influence, as well as the punishment suffered in recent months by the energy and tourism sector, harmed by the regulatory change and the expansion of omicron”, affirm from BME.

Rise margin

In this context, and although in 2022 the experts advocate caution, all is not lost for the Ibex 35. Renta4 believes that it should recover, “at least partially”, from its status as a red lantern in the Old Continent and has set a A target for the indicator of 10,700 points helped by the global economic recovery, the high weight of the banking sector in a context of normalization of monetary policy and the rebound in bond yields, in addition to the improvement in tourism.

Victoria Torre also emphasizes that in a context of “reasonable growth of the economy”, the Spanish stock market could have a profitability higher than the average in 2022, above 10%. The director of digital offer of Singular Bank estimates that some of the main heavyweights of the selective such as BBVA, Santander or Iberdrola have “significant upside potential” and “could give a boost to the Ibex 35”.

In turn, from IG they recall that the Spanish benchmark index has been one of the most affected by the coronavirus, causing fluctuations in its price “due to its dependence on cyclical companies.” For this reason, they recommend being attentive to the evolution of the economy and the actions of the central banks, since in a favorable case the selective “could visit” again the 10,000 points. To position portfolios, Sergio Ávila, the firm’s market analyst, points to defensive sectors such as ‘utilities’ (electricity, gas), “which are also usually very profitable for dividends” and to securities such as Naturgy, Endesa, Red Eléctrica, “and find a good entry point. ‘ It also points out sectors such as consumer or pharmaceutical and health care companies, as well as basic resource companies.

For his part, Diego Morín points out that the aforementioned energy companies and also related to the industry or telecos, are securities in which investors “tend to protect themselves” in times of high inflation such as the current one. Acerinox, Repsol, Iberdrola and Merlin Properties are on its radar.

From eToro they abound in the idea that if the “return to normality” occurs, the Ibex 35 could even outperform other European trading floors. At the same time, they remain prudent in the face of “dependence on the financial sector”, which according to Javier Molina “is clear and has its importance” although now Inditex or Iberdrola are the ones that weigh the most. “If we see a market where economic uncertainties continue to weigh and where there is no recovery, we will continue in the queue,” concludes this expert.

www.informacion.es

Eddie is an Australian news reporter with over 9 years in the industry and has published on Forbes and tech crunch.