Introduction: UK house price growth slows in June

Good morning, and welcome to our rolling coverage of business, the world economy and the financial markets.

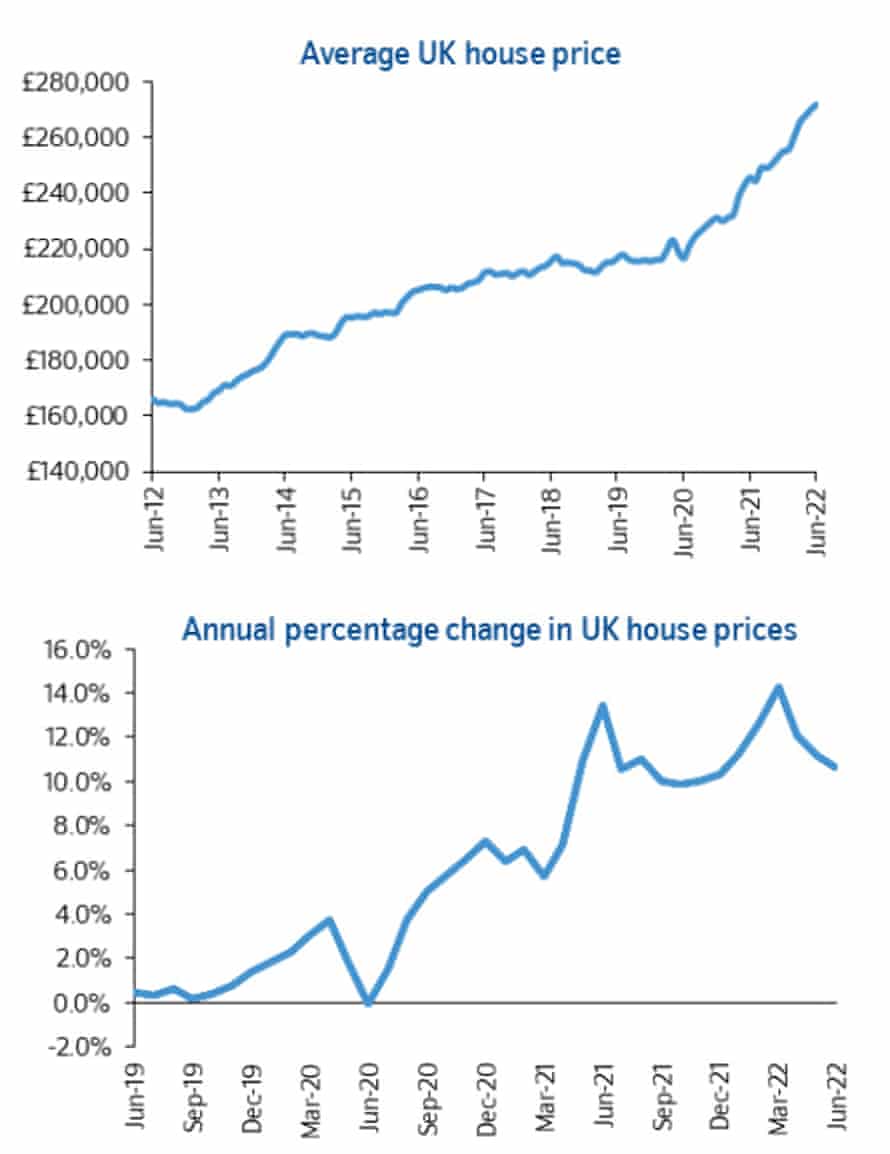

UK house prices growth slowed this month as the weakening economy, the cost of living squeeze, and rising interest rates cooled the market.

Lender Nationwide reports that prices rose by 0.3% this month, a notable slowdown on May’s 0.9% house price inflation — but still the 11th monthly rise in a row.

This pulled the annual UK house price growth to 10.7% in June, from 11.2% in May, with most regions seeing a “slight slowing” in annual growth over the last quarter.

Nationwide reports that:

- The price of a typical UK home climbed to a new record high of £271,613, with average prices up over £26,000 in the past year.

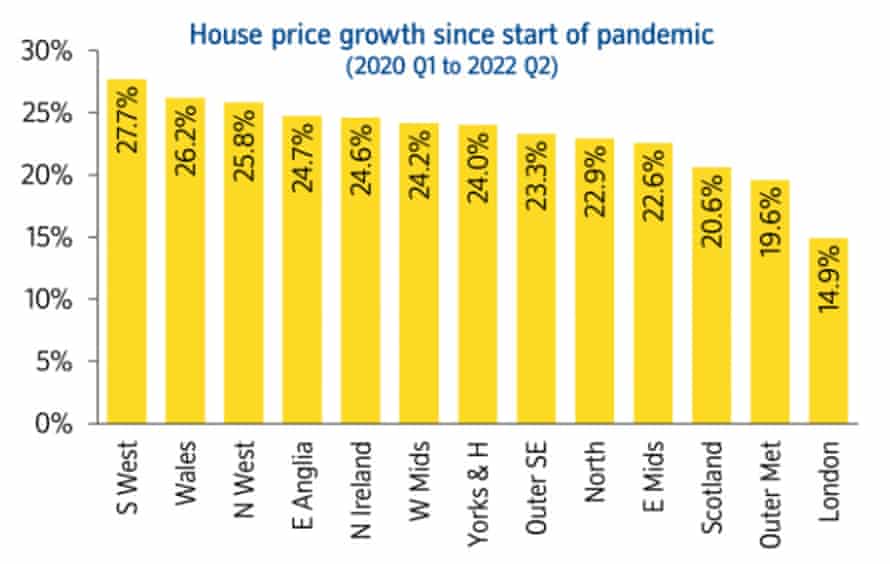

- South West overtook Wales as strongest performing region, while London remained weakest

- South West also strongest performing region through the pandemic

Robert Gardner, Nationwide’s chief economist, says the market is expected to slow further — as interest rates continue to rise:

“There are tentative signs of a slowdown, with the number of mortgages approved for house purchases falling back towards pre-pandemic levels in April and surveyors reporting some softening in new buyer inquiries.

Nevertheless, the housing market has retained a surprising amount of momentum given the mounting pressure on household budgets from high inflation, which has already driven consumer confidence to a record low.

Gardner says that the current strength of the labor market, and low availability of houses, have kept ‘upward pressure on house prices’.

But…..

“The market is expected to slow further as pressure on household finances intensifies in the coming quarters, with inflation expected to reach double digits towards the end of the year.

Moreover, the Bank of England is widely expected to raise interest rates further, which will also exert a cooling impact on the market if this feeds through to mortgage rates.

@AskNationwide HPI report shows a “modest” reduction in UK house price growth from 11.2% in May to 10.7% in June. Leaving AVG prices at £271,613 an inc of £26,000 in the past year pic.twitter.com/Y5jxeDL1qH

— Emma Fildes (@emmafildes) June 30, 2022

n”,”url”:”https://twitter.com/emmafildes/status/1542392141451862018″,”id”:”1542392141451862018″,”hasMedia”:false,”role”:”inline”,”isThirdPartyTracking”: false,”source”:”Twitter”,”elementId”:”bb4160a0-33bf-4140-8018-bad36ba558d8″}}”/>

Also coming up today

The OPEC group of oil producers holds a regular meeting to agree production targets. A big change isn’t expected this monthdespite pressure from the West to increase output.

At least five OPEC+ delegates said this week’s meeting will focus on confirming August output policies and would not discuss September, says Reuters.

A flurry of data will give us a new insight into the global economy, including French inflation, eurozone unemployment, US jobless claims and the PCE measure of US inflation.

Trade secretary Anne-Marie Trevelyan and shadow chancellor Rachel Reeves are both appearing at the British Chambers of Commerce’s annual conferencealong with business leaders and a ‘senior cabinet minister).

Christine Lagarde will close the European Central Bank’s Forum in Sintra, where Bank of England Governor Andrew Bailey warned yesterday that Britain will suffer a more severe dose of inflation than other major economies during the current energy crisis.

agenda

- 7am BST: UK Q1 GDP report (second estimate)

- 7am BST: Nationwide house price index for June

- 7.45am BST: French inflation report for June

- 8.30am BST: Swedish Riksbank interest rate decision

- 10am BST: Eurozone unemployment report for May

- 1.30pm BST: US weekly jobless claims

- 1.30pm BST: US PCE measure of inflation for May

- 2.30pm BST: ECB president Christine Lagarde speech.

House price growth continues to “drift downward” in response to mounting pressures in the broader economy, says Nicki Stevensonmanaging director of national estate agent group Fine&Country:

“Increased borrowing costs have come at a time when disposable incomes are already shrinking and the UK is edging closer to recession.

“These pressures are bound to stretch affordability in the months ahead with inflation still to peak and more aggressive monetary tightening now being signaled by the Bank of England.

“A tight labor market and the ongoing supply crunch will continue to mitigate this cooling effect with overall gains remaining robust by historical standards.”

London remains the weakest performing region for house price growth since the start of the pandemic.

the south west saw the largest increase, as people looked for larger, more rural properties in the move to home-working.

Nationwide reports that:

Since 2020 Q1, average house prices in the capital have increased by 14.9%, whilst all other regions, except the Outer Metropolitan, have seen at least a 20% uplift.

“The South West was also the strongest region over this period, with a 27.7% increase, after taking account of seasonal effects, followed by Wales, where average prices rose 26.2%. Meanwhile in the North West, prices were up 25.8%.

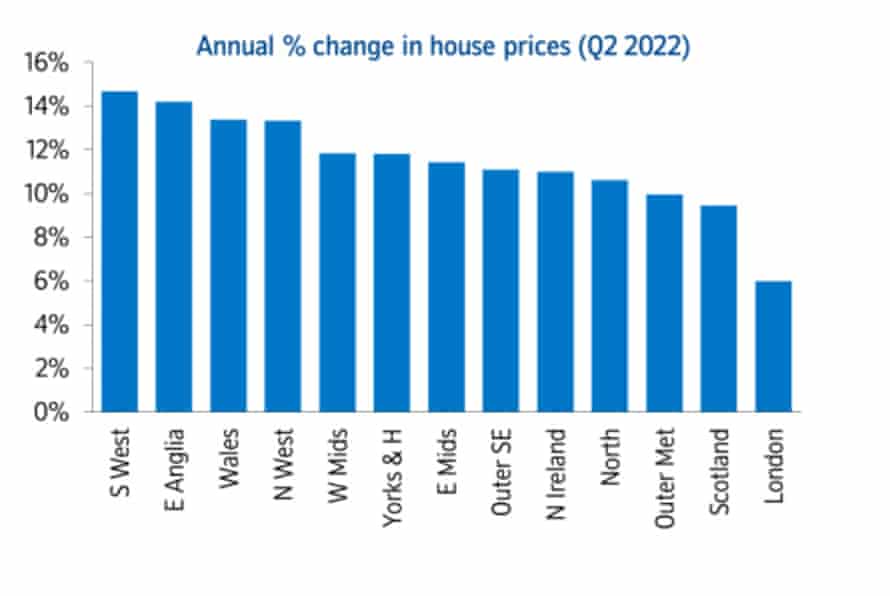

House prices across the South West jumped 14.7% year-on-year in the last quarter, as it overtook Wales as the strongest performing region in Q2

It was followed by East Anglia, where annual price growth remained at 14.2%, Nationwide reports.

Wales saw a slowing in annual price growth to 13.4%, from 15.3% in the first quarter.

Price growth in Northern Ireland was similar to last quarter at 11.0%. Meanwhile, Scotland saw a 9.5% year-on-year rise in house prices.

Introduction: UK house price growth slows in June

Good morning, and welcome to our rolling coverage of business, the world economy and the financial markets.

UK house prices growth slowed this month as the weakening economy, the cost of living squeeze, and rising interest rates cooled the market.

Lender Nationwide reports that prices rose by 0.3% this month, a notable slowdown on May’s 0.9% house price inflation — but still the 11th monthly rise in a row.

This pulled the annual UK house price growth to 10.7% in June, from 11.2% in May, with most regions seeing a “slight slowing” in annual growth over the last quarter.

Nationwide reports that:

- The price of a typical UK home climbed to a new record high of £271,613, with average prices up over £26,000 in the past year.

- South West overtook Wales as strongest performing region, while London remained weakest

- South West also strongest performing region through the pandemic

Robert Gardner, Nationwide’s chief economist, says the market is expected to slow further — as interest rates continue to rise:

“There are tentative signs of a slowdown, with the number of mortgages approved for house purchases falling back towards pre-pandemic levels in April and surveyors reporting some softening in new buyer inquiries.

Nevertheless, the housing market has retained a surprising amount of momentum given the mounting pressure on household budgets from high inflation, which has already driven consumer confidence to a record low.

Gardner says that the current strength of the labor market, and low availability of houses, have kept ‘upward pressure on house prices’.

But…..

“The market is expected to slow further as pressure on household finances intensifies in the coming quarters, with inflation expected to reach double digits towards the end of the year.

Moreover, the Bank of England is widely expected to raise interest rates further, which will also exert a cooling impact on the market if this feeds through to mortgage rates.

@AskNationwide HPI report shows a “modest” reduction in UK house price growth from 11.2% in May to 10.7% in June. Leaving AVG prices at £271,613 an inc of £26,000 in the past year pic.twitter.com/Y5jxeDL1qH

— Emma Fildes (@emmafildes) June 30, 2022

n”,”url”:”https://twitter.com/emmafildes/status/1542392141451862018″,”id”:”1542392141451862018″,”hasMedia”:false,”role”:”inline”,”isThirdPartyTracking”: false,”source”:”Twitter”,”elementId”:”13137bf7-fa2f-4c43-a9f3-b3649dc9ca75″}}”/>

Also coming up today

The OPEC group of oil producers holds a regular meeting to agree production targets. A big change isn’t expected this monthdespite pressure from the West to increase output.

At least five OPEC+ delegates said this week’s meeting will focus on confirming August output policies and would not discuss September, says Reuters.

A flurry of data will give us a new insight into the global economy, including French inflation, eurozone unemployment, US jobless claims and the PCE measure of US inflation.

Trade secretary Anne-Marie Trevelyan and shadow chancellor Rachel Reeves are both appearing at the British Chambers of Commerce’s annual conferencealong with business leaders and a ‘senior cabinet minister).

Christine Lagarde will close the European Central Bank’s Forum in Sintra, where Bank of England Governor Andrew Bailey warned yesterday that Britain will suffer a more severe dose of inflation than other major economies during the current energy crisis.

agenda

- 7am BST: UK Q1 GDP report (second estimate)

- 7am BST: Nationwide house price index for June

- 7.45am BST: French inflation report for June

- 8.30am BST: Swedish Riksbank interest rate decision

- 10am BST: Eurozone unemployment report for May

- 1.30pm BST: US weekly jobless claims

- 1.30pm BST: US PCE measure of inflation for May

- 2.30pm BST: ECB president Christine Lagarde speech.

www.theguardian.com

George is Digismak’s reported cum editor with 13 years of experience in Journalism